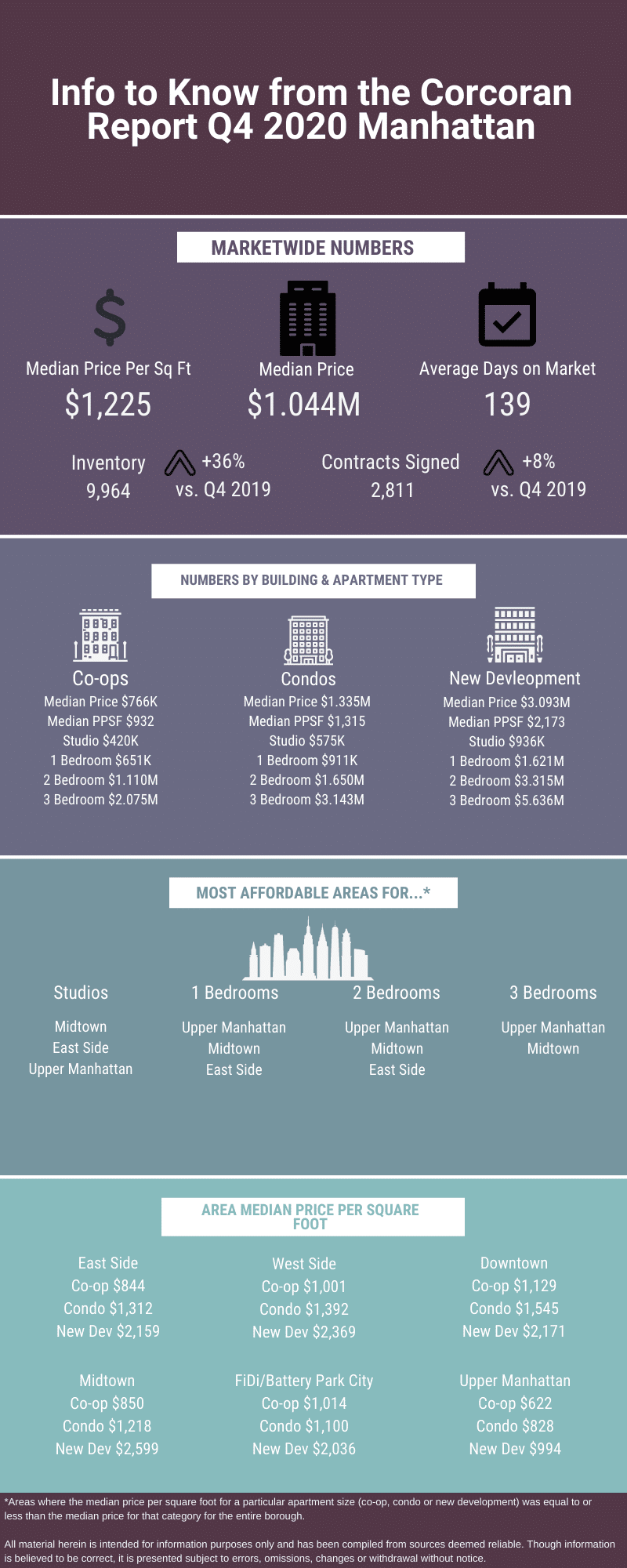

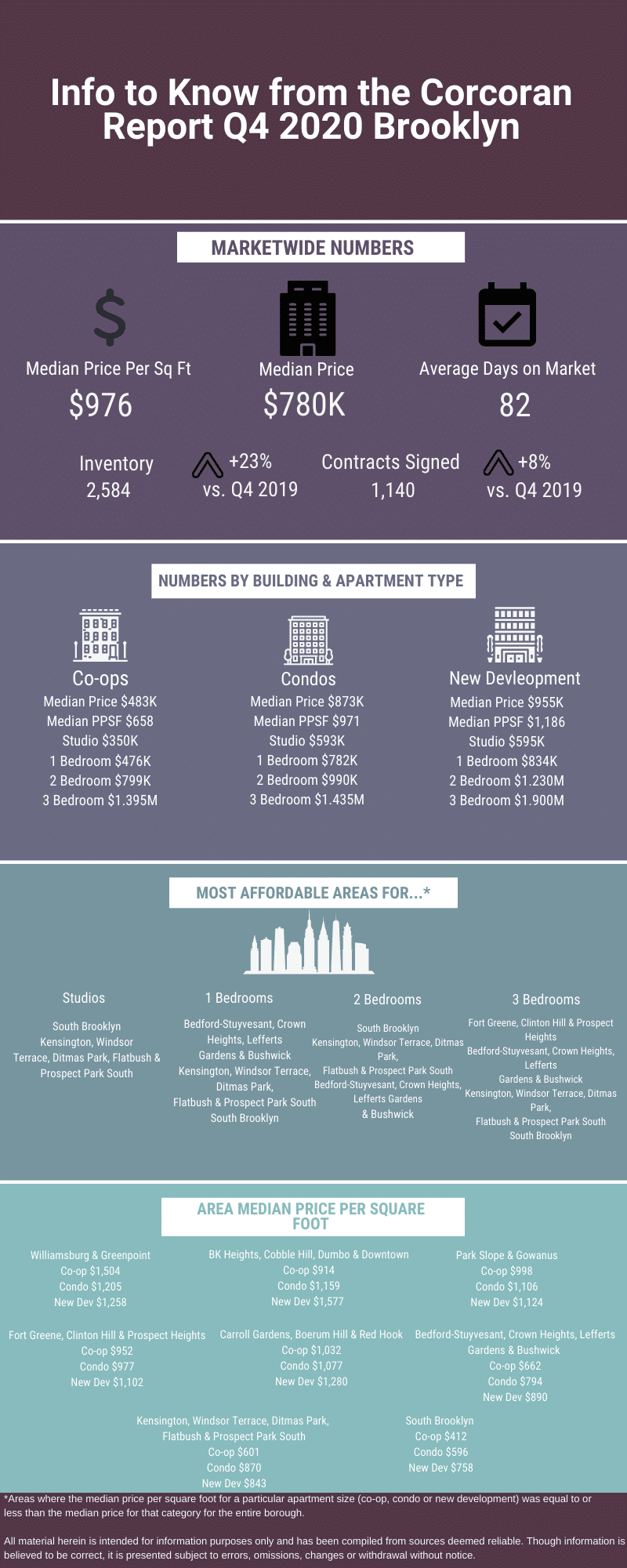

It’s time to take a look at how residential sales fared in Manhattan and Brooklyn during Q4 2020. Check out the infographic below. You can view the full report for Manhattan here and the full report for Brooklyn here.

In Manhattan, sales showed signs not just of stabilization, but also a possible recovery.

Inventory remained high versus 2019 as did days on market. But inventory grew less versus Q3 2020 and days on market also decreased quarter over quarter.

Closed sales were down significantly year over year (30%), but up 18% versus Q3 2020. And contracts signed were actually up month over month and year over year.

Meanwhile, the median price and average price showed some modest yet interesting fluctuations year over year. The average price per square foot was down 8% versus 2019, but the overall median price was actually up by 4%.

A similar story played out in Brooklyn. But it’s important to note that the borough didn’t see the kind of decline Manhattan did during 2020, by comparison.

Inventory remained significantly higher than last year (up 23%). But like Manhattan, the pace of new inventory slowed quarter over quarter.

However, unlike Manhattan, both the median price and the average price per square foot were up both year over year and quarter over quarter. Additionally, buyer interest in the borough was definitely stronger – days on market decreased compared to both 2019 and Q3 2020.

The advantages that buyers enjoyed in the summer and fall of 2020 seem to be fading, as it looks like we’re in the midst of a more “neutral market” these days – no one quite has a clear upper hand. It’s really area by area, deal by deal.

Inventory continues to remain at record levels, but sellers have a bit more leverage than they had several months ago. In fact, sellers of high demand properties (i.e. townhouses and homes with private outdoor space) have somewhat of an advantage (check out this article for more details on this point).

So what does it all mean?

The key takeaway is that buyers will need to adjust their expectations.

As long as a property is well priced, it’ll get interest. And while you may not find yourself in a multiple bid situation, sellers who feel confident in their pricing aren’t going to be receptive to unjustified lowball offers.

Remember – any market adjustments caused by COVID-19 are already reflected in the asking prices (and if you don’t remember that, then I recommend you read this blog post).

If vaccination rates really ramp up and infection rates continue their downward trend, that may lead to even more optimism in the market. And hence, more buyer competition.

Want more information about a specific residential sales segment in Manhattan or Brooklyn during Q4 2020? Just contact me to discuss!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.