It’s time to take a look at the NYC real estate market update for Q4 2021.

To view the full report, visit the links below:

Corcoran NYC Real Estate Market Update Q4 2021 – Manhattan

Corcoran NYC Real Estate Market Update Q4 2021 – Brooklyn

Thanks to a strong third quarter in contract signings, closed sales in Q4 were up a staggering 89% year over year.

And contract signings themselves remained solid. They saw an increase of 47% year over year and a 15% increase quarter over quarter.

Other metrics also indicated that Manhattan was firmly rooted in its renewal – days on market were down; inventory was down sharply year over year; and the median price was up versus Q4 2021.

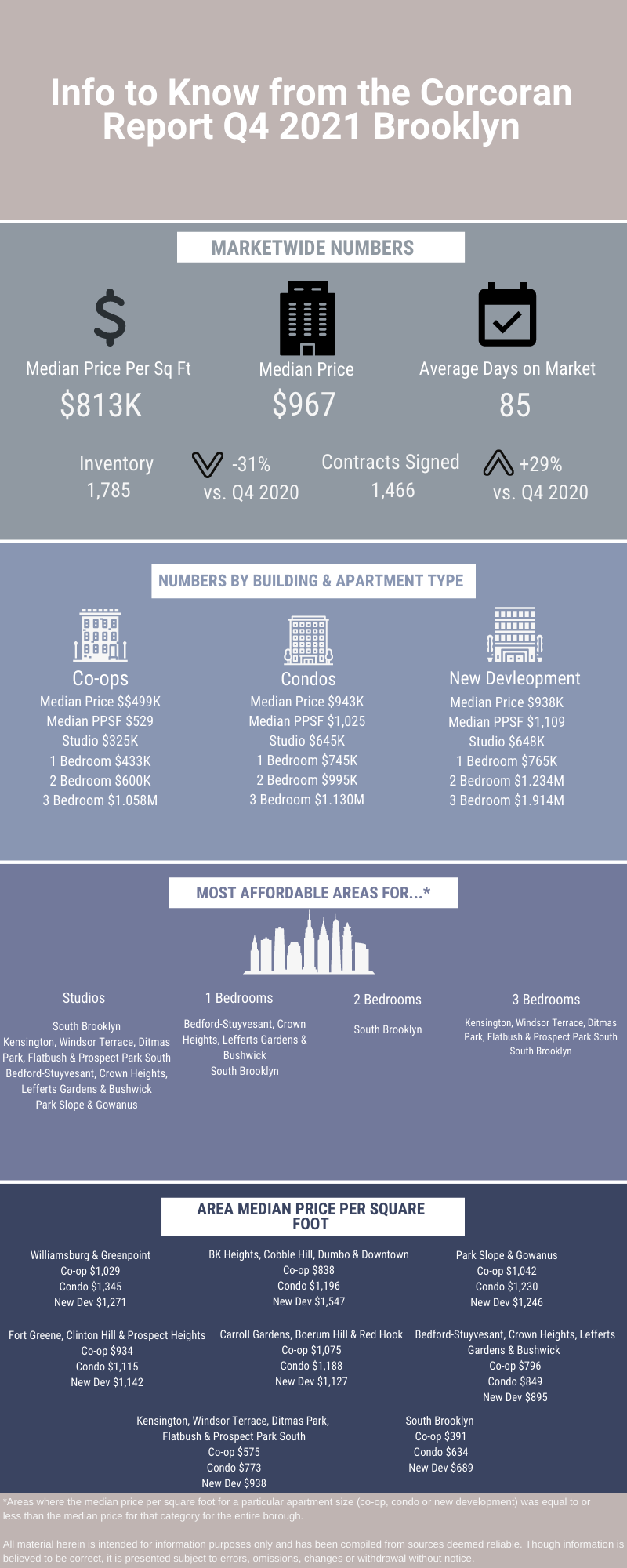

Brooklyn didn’t see the same level of year over year increases, but it certainly still motored along just fine.

Closed sales were up 15% year over year and contracts signed were up 29% year over year.

Although days on market ticked up ever so slightly, inventory decreased significantly – 31% year over year and 27% quarter over quarter. And the median price continued to tick upward, landing at $813,000.

Omicron has come along and thrown a wrench in NYC’s recovery plans. And it’s possible that we may see lower than usual sales figures for the month of January. But the current wave of infections is showing clearer signs of receding, which means that the beginning of the year is likely to be a “pause” and not necessarily a decline.

That being said, to what extent it will be more of a buyer’s market or a seller’s market could largely depend upon inventory.

If a lot of inventory is released on the market, then in Manhattan, we could see things shift more in favor of buyers (but only slightly). There’s likely to be a bit less of a shift in Brooklyn. But at a minimum, more inventory would mean less pressure for buyers.

However, if inventory remains muted, we could see a very frenzied end to the winter sales market. And a big boom to kick off the typically busy spring sales season by March.

Everyone will be keeping an eye on interest rates. Omicron has sown some doubts about economic strength, and inflation remains a concern. So it’s entirely possible we may see the first of the Federal Reserve’s rate hikes take place some time in Q1 2022. And that could have a huge impact on the cost of ownership for would be buyers.

Thinking about buying but not sure if you’re ready? Then sign up for my First Time Buyer Bootcamp to help you figure it out! Join here!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.