It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for March 2022 in Manhattan and Brooklyn. Click here to view the previous monthly sales market update.

To view the full NYC sales market monthly update for March 2022, click here.

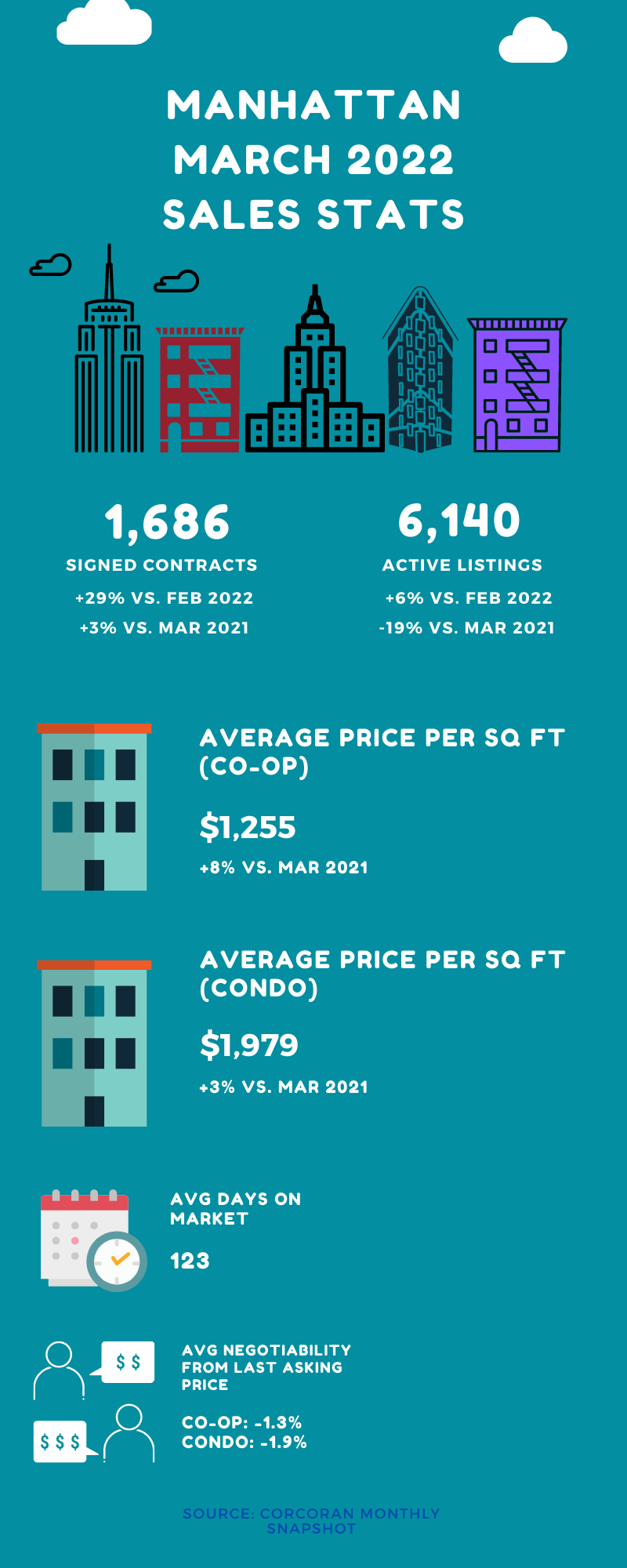

With another strong month under its belt, it’s officially safe to say that Manhattan’s sales recovery has solid momentum.

Contracts signed were up 3% versus March 2021, and the average price per square foot continued its year over year climb upwards. But it’s noteworthy that prices actually declined month over month, indicating a higher level of resales and fewer luxury sales.

Days on market declined sharply month over month. And while inventory ticked upwards month over month (which we’d expect due to seasonality), the number of available listings was down by 19% compared to last year. Both are clear indicators of buyer interest.

However, it’s still not quite a “seller’s market,” since negotiability stood at 1.6% below asking.

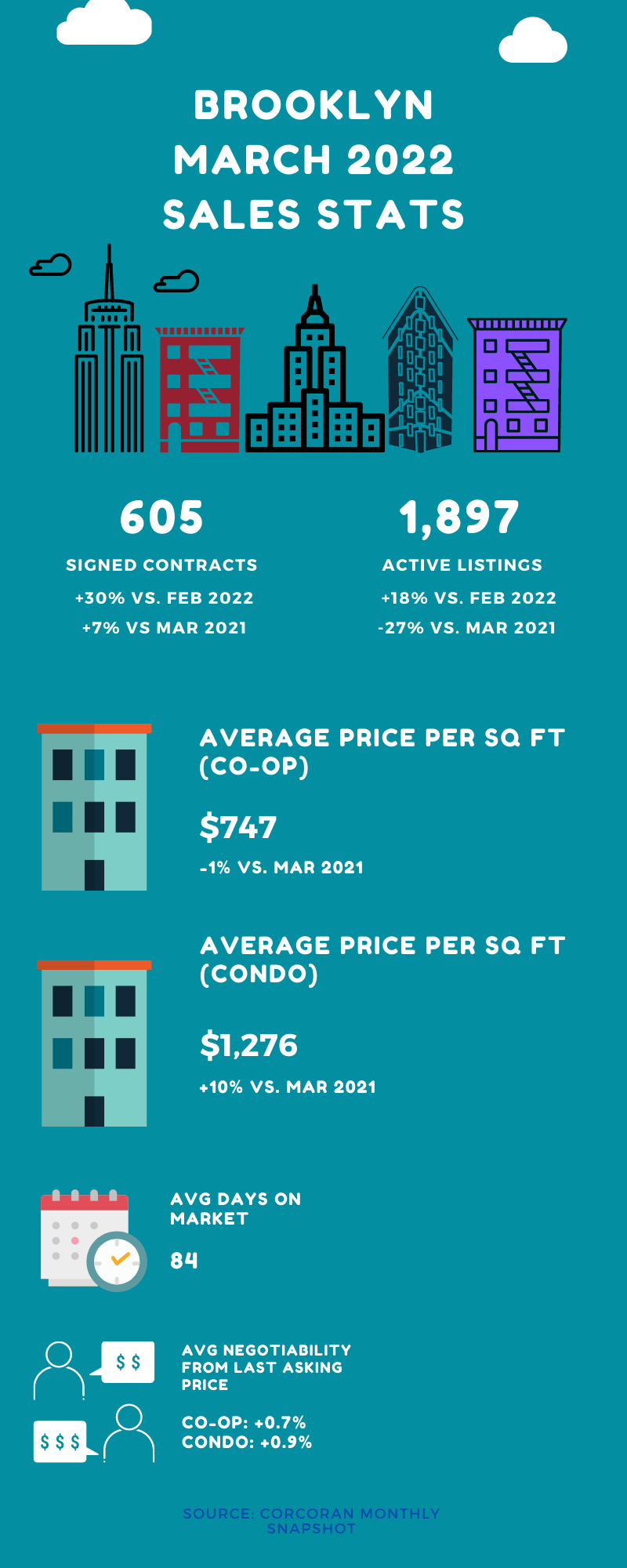

Things were also looking very good for Brooklyn in March. Contracts signed were up 7% year over year and a whopping 30% month over month. Buyers certainly came out in force for the start of the spring sales season.

Days on market were down significantly versus March 2021. And while inventory did increase month over month by 18%, it was down 27% compared to last year.

And thanks to that tighter inventory and increased buyer interest, it seems that things are finally edging more towards a proper seller’s market, with negotiability sitting at 0.8% above asking for the month of March.

The sales market really seems to have shrugged off the Omicron wave from earlier this year in both boroughs. And it also seems to have not been largely impacted by global issues and rising interest rates.

April will be telling for how much impact rates will have going forward. On the one hand, some buyers may end up not being able to afford what they originally wanted due to higher monthly payments. This could cause them to drop out of the market or lower their price range. But both the Manhattan and Brooklyn markets are notorious for having buyers who aren’t heavily dependent upon financing to buy homes. So the overall net effect of interest rate increases could be much smaller than anticipated.

If you’re on the hunt for a new place to call home, then make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.