You know that mortgage interest rates impact home purchasing power. But what does that actually look like in terms of dollars and cents?

Let’s check out a few examples to find out! We’ll be using the term “basis points” to refer to the increases and decreases.

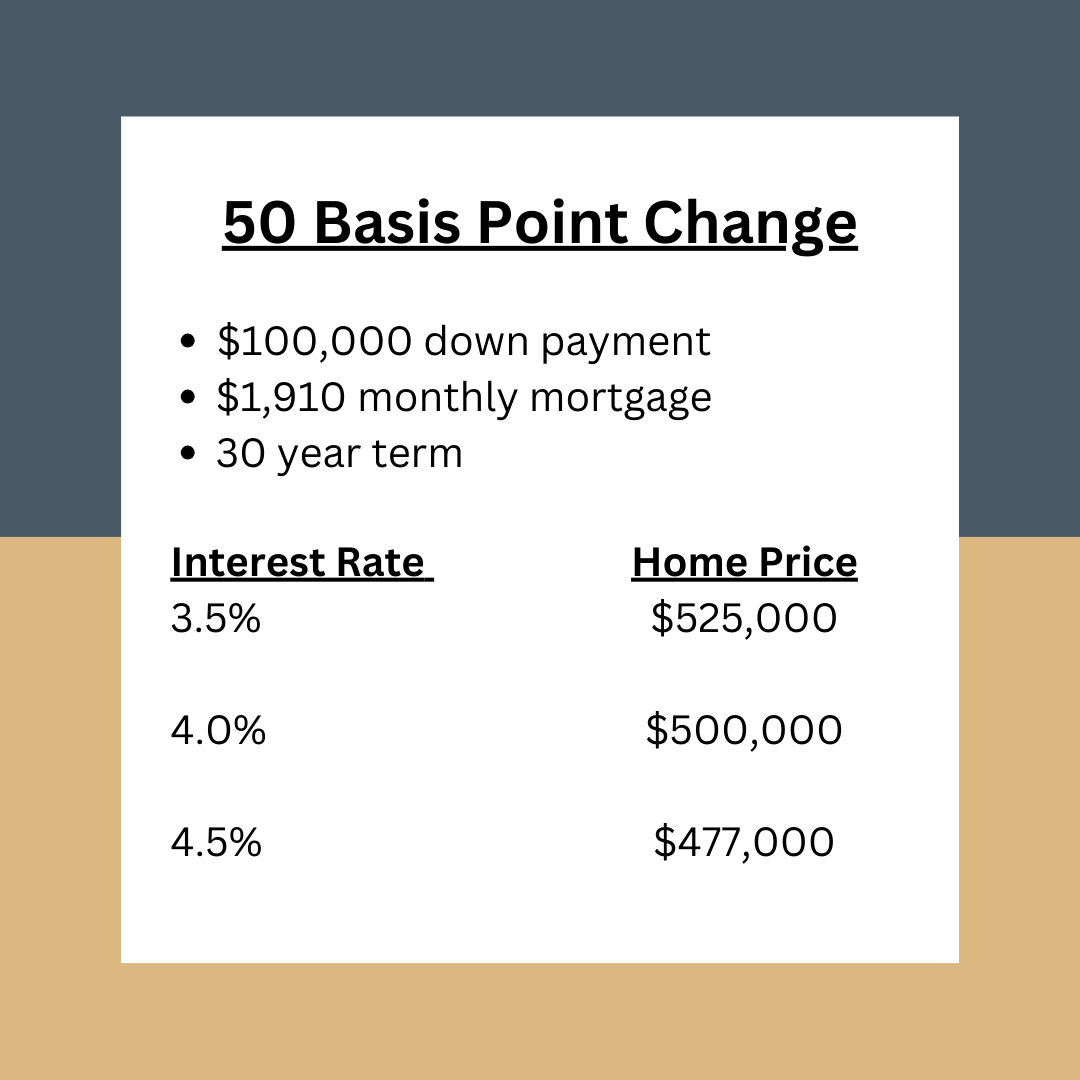

First up, let’s check out the impact of a 50 basis point (0.50) change. We’ll do two examples.

Example 1

Our buyer has $100,000 to put towards a down payment, and they can afford to pay approximately $1,910 per month for a monthly mortgage with a term of 30 years.

If interest rates are at 4%, they can afford a home priced up to $500,000 with a 20% down payment. (P.S. How did I get this number? I used this calculator.)

But if interest rates are at 4.5%, in order to stay at a monthly mortgage of $1,910, they can only afford a home priced up to about $477,000. That’s $23,000 of purchasing power lost.

Example 2

Let’s say interest rates decline to 3.5%. If the target monthly mortgage is still $1,910, then this means they can now afford a home priced up to $525,000. So their purchasing power increased by $25,000.

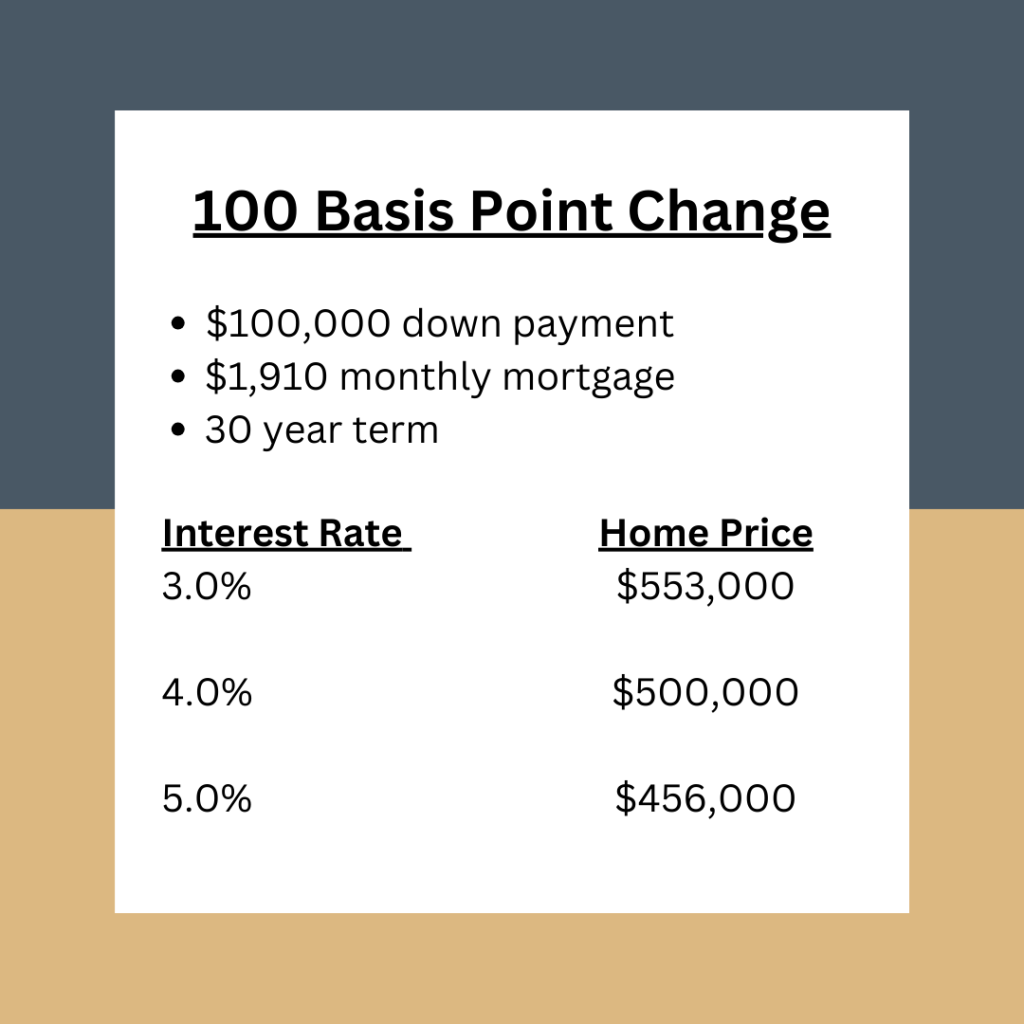

Now, let’s look at the impact of a 100 basis point (1.0) change. We’ll again use two examples, with the same monthly mortgage limits as noted above and our baseline interest rate is 4%.

Example 1

If interest rates increase to 5.0%, our buyer can only afford a home priced up to $456,000 in order to stay at a monthly mortgage of $1,910. That’s $44,000 of purchasing power lost compared to a rate of 4.0%

Example 2

If interest rates are at 3.0%, our buyer can now afford a home priced up to $553,000. That’s $53,000 in purchasing power gained compared to a rate of 4.0%

As you can see, shifts in interest rates – even small ones – can mean a big difference in your home affordability. This is why it’s so important to stay on top of what’s happening. Doing so will position you to take advantage when rates drop. Even in a high interest rate environment, you should take note of movement. For example, during 2022 and 2023, which saw some of the highest rates in more than ten years, rates still dropped from time to time.

Although you can’t control how much rates rise, there are steps you can take to help manage them so that you get an optimal rate. If you’d like to know more, then you should speak to a mortgage professional. And if you don’t know any, then contact me. I know quite a few 😉

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.