It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for September 2022 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for September 2022, click here. And to view stats for the previous month, click here.

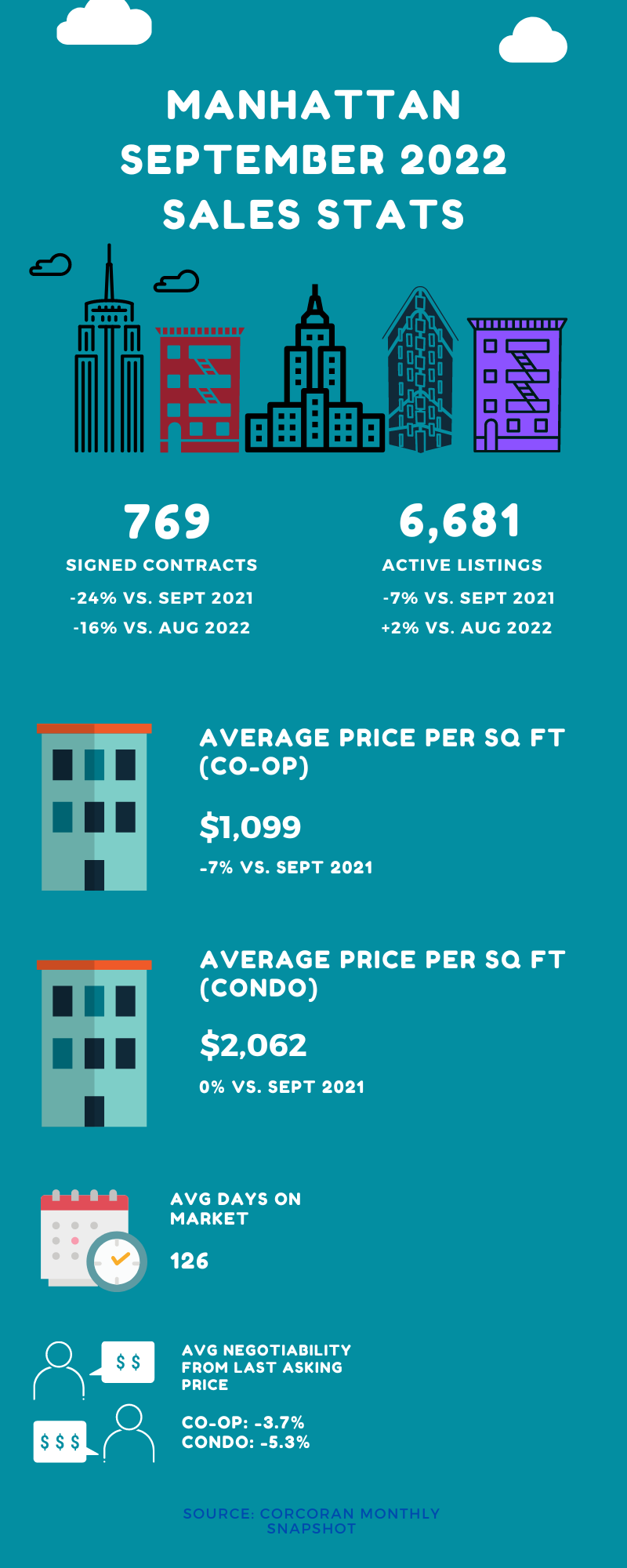

Contracts signed continued their annual and monthly decline in Manhattan, with sales down 24% versus September 2021 and down 16% versus August 2022.

There’s now additional signs of market softening. Although the average price per square foot was up both year over year and month over month, these closings reflected sales from earlier in the summer when interest rates were lower. Days on market actually increased by 20% compared to August. And listing inventory ticked up slightly compared to the previous month.

The change in the Manhattan market was most apparent in the negotiability factor. It stood at 4.6% below the asking price.

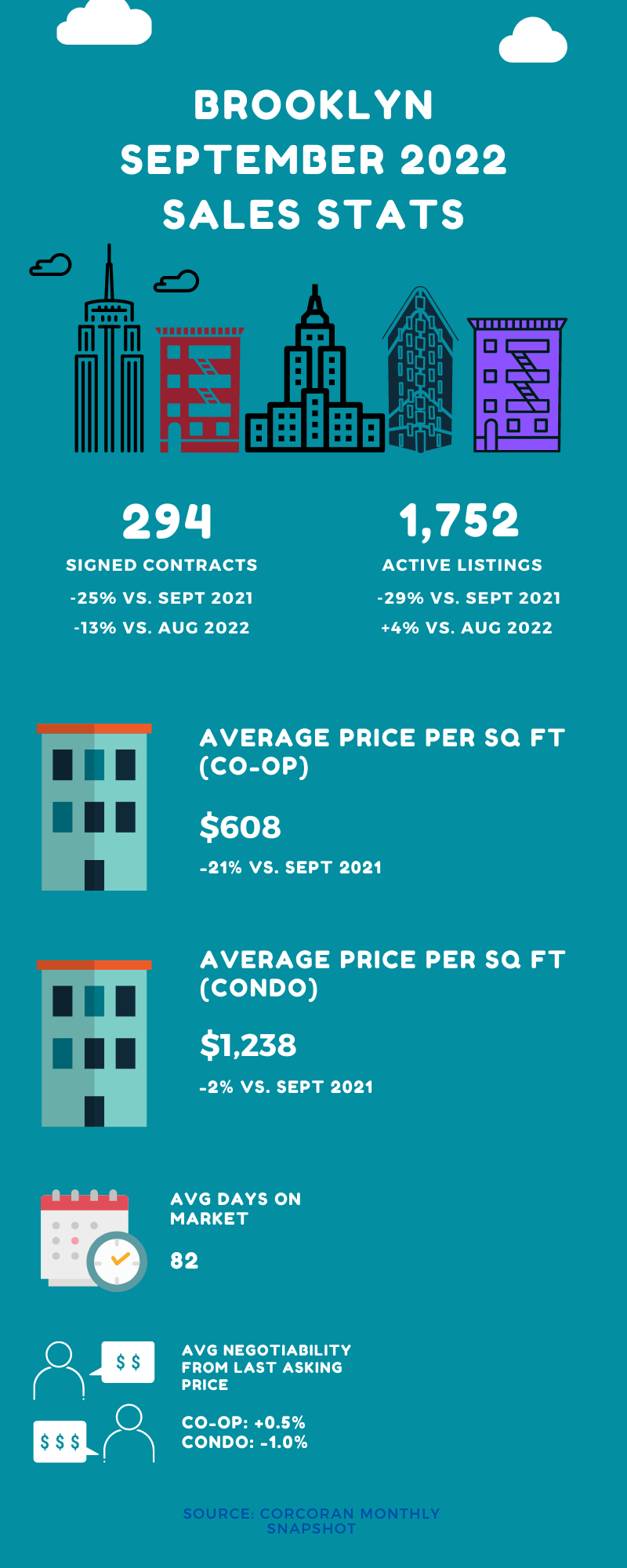

Brooklyn likewise saw year over year and month over month declines in contract signings (25% and 13%, respectively).

And the borough is also seeing a market shift taking place. Unlike Manhattan, the average price per square foot declined compared to last year and last month. And this happened despite inventory being 29% lower versus September 2021. But the tighter inventory meant that properties moved faster, since the average days on market took a tumble compared to last year.

And when it comes to negotiability, buyers and sellers are now on more even footing. The negotiability factor stood at 0.6% below asking.

As previously predicted, prices are starting to come down. But so far, the declines are modest. This is likely to remain the case given the low inventory. Sellers aren’t too keen to list their properties if they don’t have to, especially if it means letting go of a really low interest rate.

But things are still shifting in buyer’s favor when it comes to being able to negotiate prices. The most recent interest rate increase by the Fed likely has some sellers concerned about moving their properties. So they may be more receptive to offers that they previously might’ve declined.

With the latest report on inflation, we expect that interest rates are going to continue to rise for the remainder of the year. So more buyers are likely to stay on the sidelines.

But less competition and more flexibility on price could present more intrepid buyers with some great opportunities (especially if you’re looking for a studio or 1 bedroom).

If you’re on the hunt for a new place to call home, then make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.