It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for October 2022 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for October 2022, click here. And to view stats for the previous month, click here.

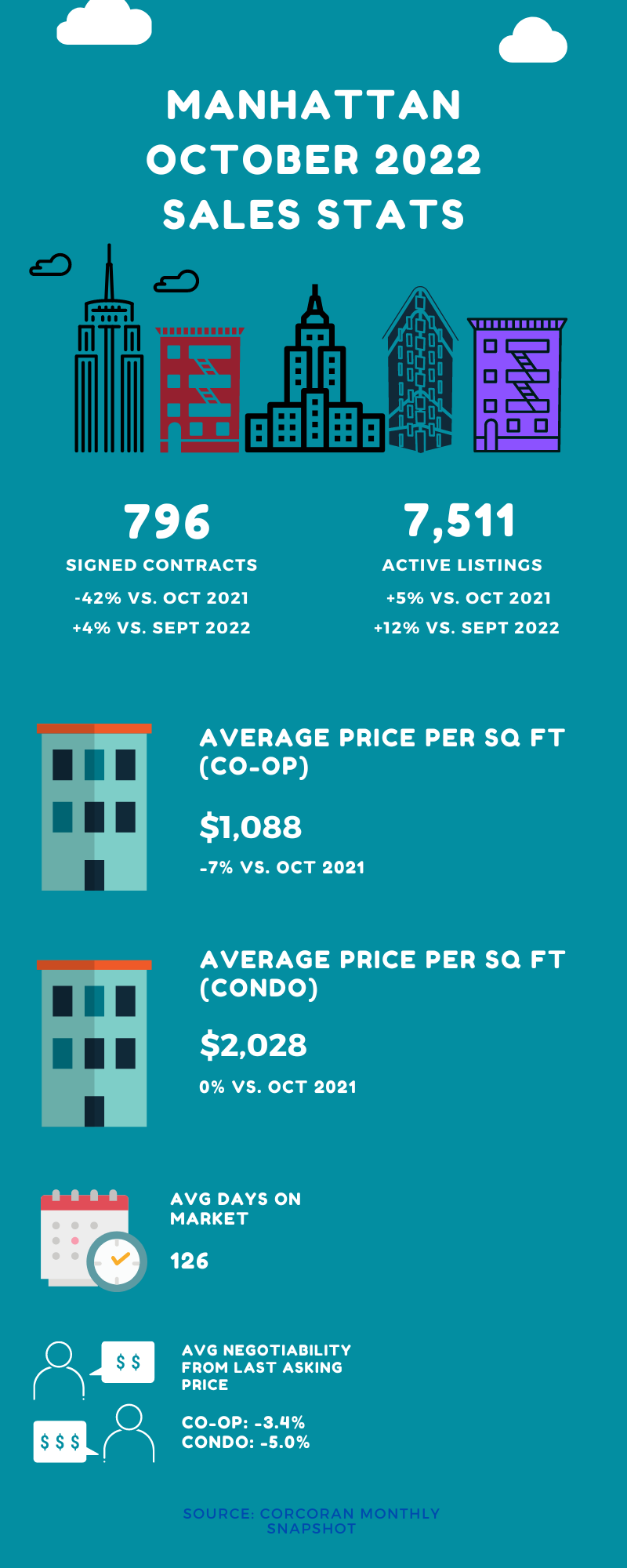

Contracts signed were down sharply year over year in Manhattan (42%), but they actually increased month over month. This may have been due to buyers wanting to lock in lower interest rates while they could.

The market continued to soften according to other metrics. Active listings were up both year over year and month over month. And days on market were up 10% versus October 2021.

Although there wasn’t much of a month over month change, negotiability remained favorable to buyers. It stood at 4.4% below the asking price for the market overall.

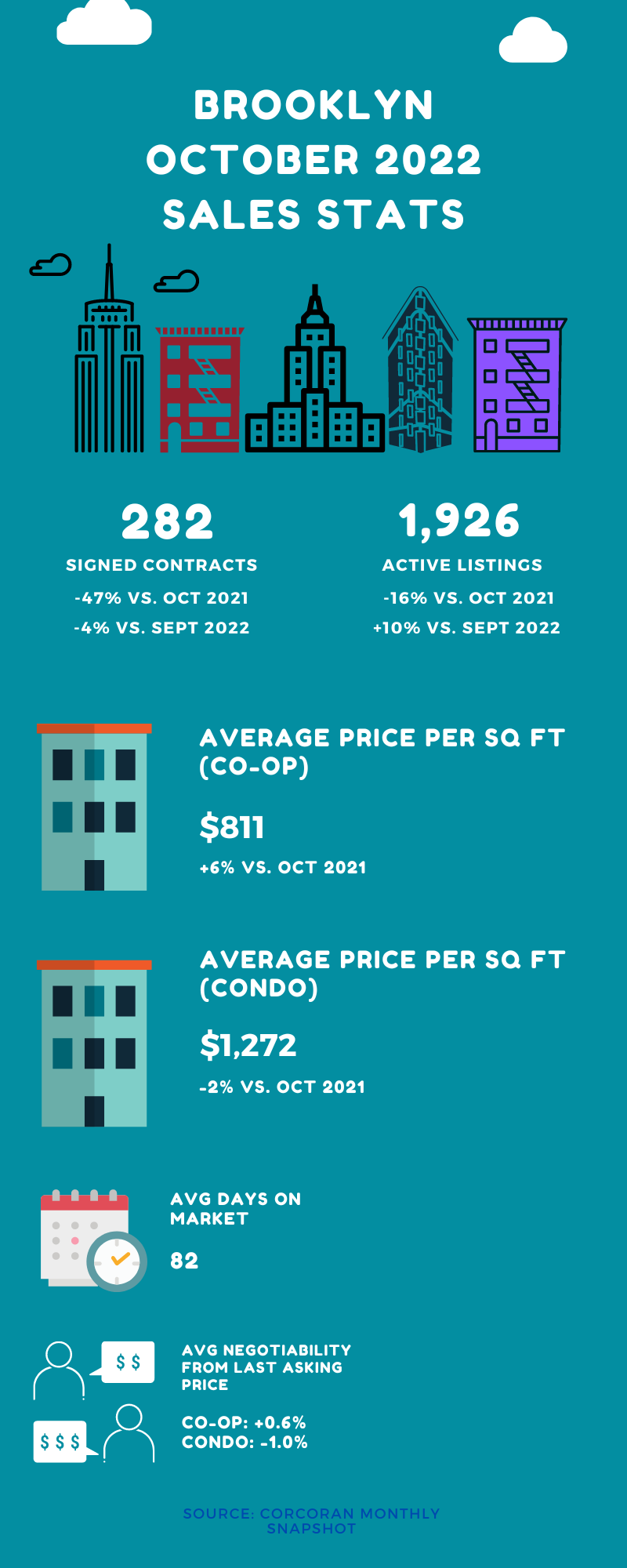

Brooklyn also saw annual and monthly declines in contracts signed (47% and 4%, respectfully).

However, it seems the borough might be experiencing less of a slowdown compared to its East River counterpart. Inventory was up month over month, but down markedly year over year (16%). And while the price per square foot was slightly lower compared to October 2021, it was higher compared to the previous month.

And buyers still don’t quite have that big of an edge. Like last month, the negotiability factor stood at 0.6% below asking.

We expect to see more notable price declines starting in November. The reason?

First, of course, is interest rates. Sellers will either need to price their properties lower to garner interest or will have to be more willing to accept below asking prices to get a deal done.

The second reason – more closed sales from late summer. These sales are going to reflect the rapid shift in interest rates that occurred much more so than last month’s closed sales. This will in turn affect the available sales comparables that brokers use to price listings. Thus resulting in lower list prices.

But buyers shouldn’t expect to get deep discounts. As noted in this article from UrbanDigs’ John Walkup, there’s not a glut of inventory (far from it in Brooklyn, especially). And sellers aren’t desperate to sell. And although sales are markedly lower than last year, it’s important to remember that last year was recording breaking. So we’re likely settling back into normal purchase patterns.

But that being said, there are opportunities out there for buyers. Competition is certainly less intense, and more sellers that are on the market are receptive to offers they wouldn’t previously have considered. So while you might be paying a higher interest rate (which you could refinance later, with some caveats), you could potentially compensate for it with a better sales price.

If you’re on the hunt for a new place to call home, then make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.