It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for February 2023 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for February 2023, click here. And to view stats for the previous month, click here.

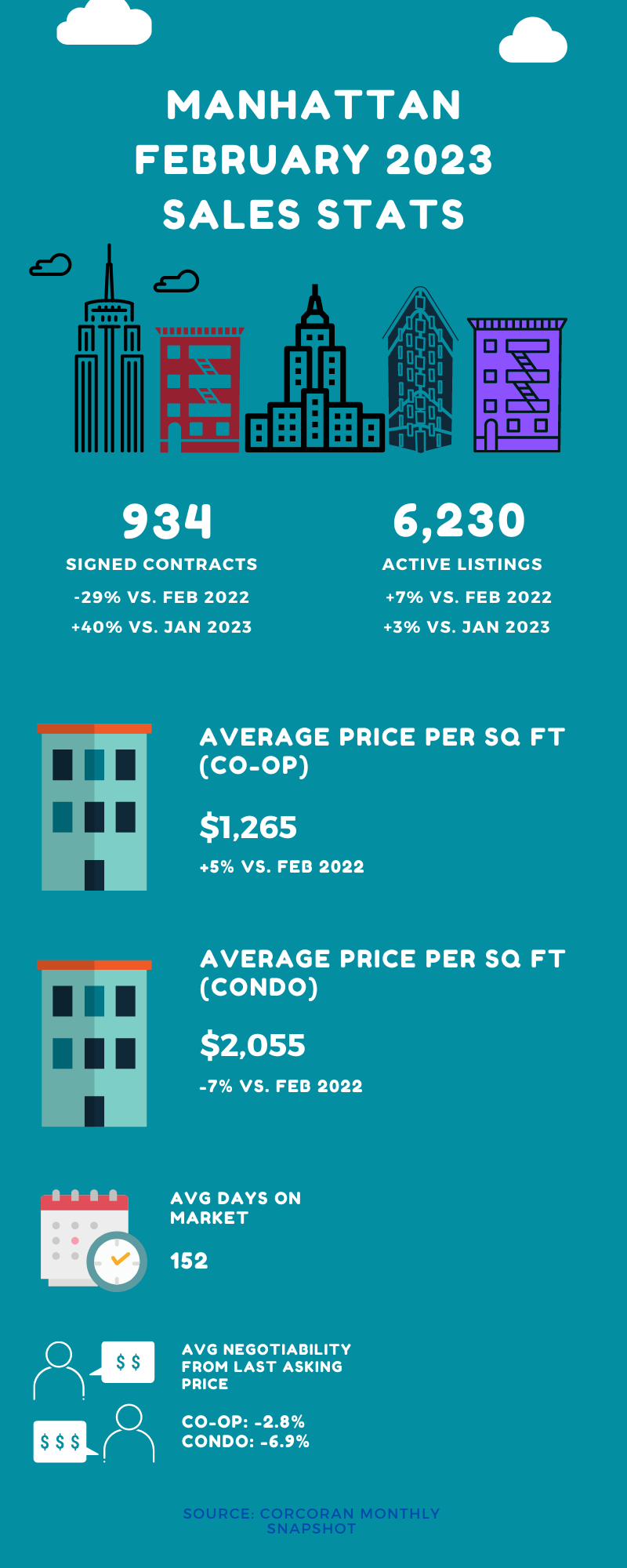

The market may be gearing up for an awakening if February’s numbers are any indication. Although contracts signed were down 29% year over year, they rebounded 40% compared to January. This is one of the biggest month over month upticks since late 2020.

Prices continued to decline on a monthly basis, albeit modestly. But they were flat year over year.

And inventory had good news for both buyers and sellers. Listings increased both annually and monthly. But the total number of properties for sale was still below the typical February average of 6,800. So this means prospective sellers aren’t facing a glut of competition.

The negotiability factor remained fairly steady compared to the last month at 5.5% below asking. This indicates that buyers still have quite a bit of leverage.

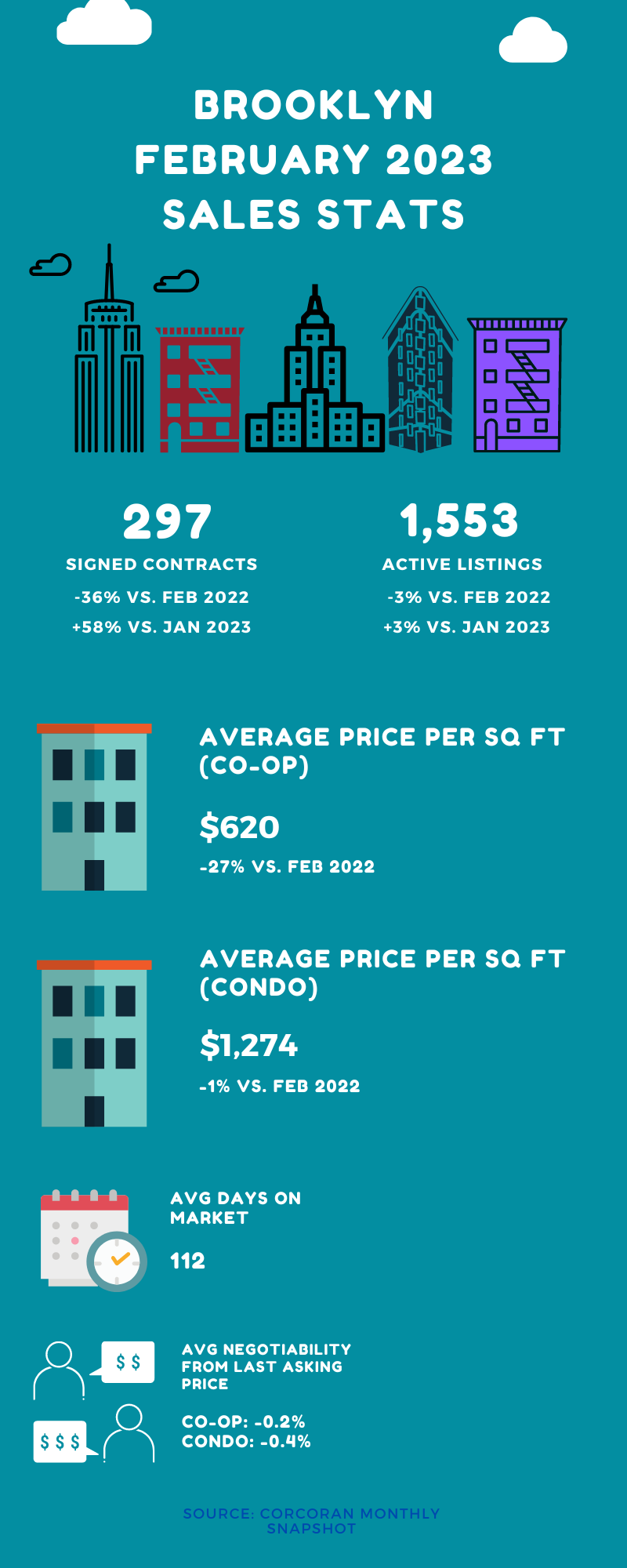

Brooklyn also saw a pop of activity for the month of February. Like Manhattan, sales were down on an annual basis (36%), but they skyrocketed compared to the previous month (up 58%)

Prices continued to decline on a monthly basis, but they were actually up compared to January 2022.

And buyers aren’t seeing much in the way of relief when it comes to inventory in the borough. Although it ticked upwards by 3% compared to January, inventory was down 3% compared to February 2022.

And the negotiability reflects the fact that sellers and buyers are on more even ground compared to Manhattan. It stood at just 0.3% below asking.

The anecdotal evidence from last month turned out to be true. But what’s likely to happen in March is a bit murkier.

Inventory typically ticks up significantly this time of year. But it’s unclear how much new inventory will hit for 2023 given persistently high interest rates.

But the story has changed regarding interest rates in light of the failure of Silicon Valley Bank and Signature Bank. Both have rattled the markets enough to make the Fed reconsider its plan to increase rates.

This may mean either stabilizing or decreased rates going forward. And that in turn may encourage more buyers back into the market. Which could lead to more sales. Which could lead to more listings. You see where I’m going with this 😉

If you’re on the hunt for a new place to call home, then make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.