It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for May 2023 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for May 2023, click here. And to view stats for the previous month, click here.

Key Points

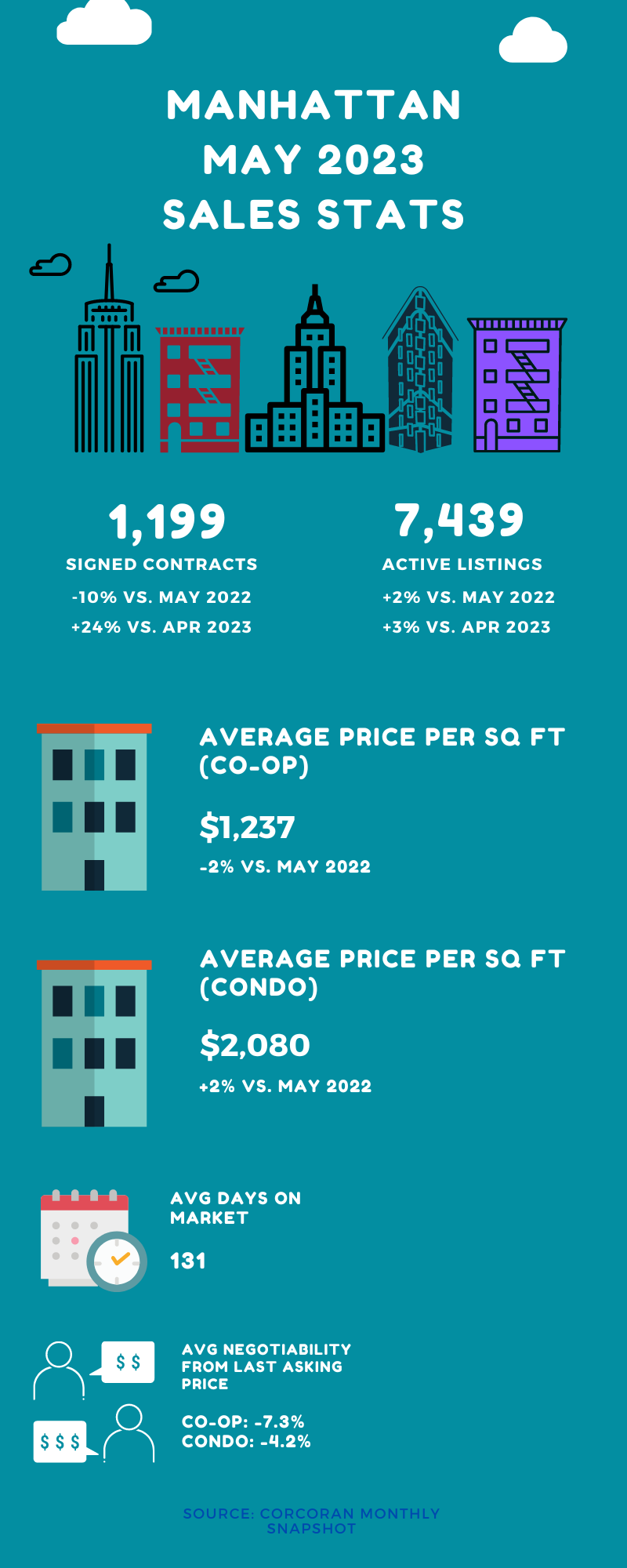

Although sales were down in Manhattan on an annual basis, they rebounded strongly compared to April. Sales increased 24% month over month and were on par with historical trends for the month of May.

But other market indicators show signs that we’re very much still in a buyer’s market.

Inventory continued to increase, reaching over 7400 listings. This is the highest level seen since June 2021. And days on market were also up – 8% compared to April and 30% compared to last year.

Although prices remained pretty flat compared to 2022, buyers enjoyed some solid discounts in May. The negotiability factor stood at 5.6% below asking. This was driven primarily by a high number of luxury sales which sold for more than 10% off.

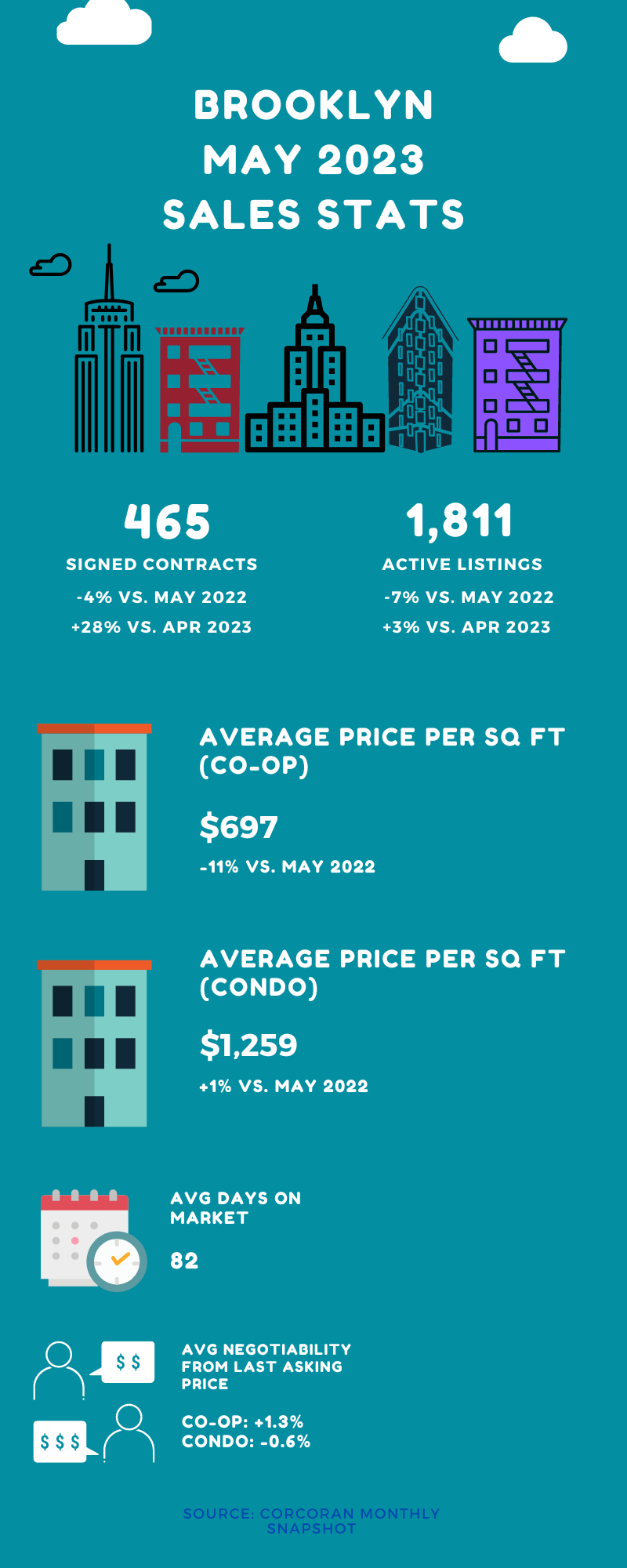

In Brooklyn, buyers and sellers are on much more equal footing.

Like Manhattan, sales were down on an annual basis. But they saw a big uptick compared to April (up 28%).

Other market indicators were a bit more mixed. Inventory increased slightly month over month. And the average price per square foot for the borough was flat year over year. Days on market were down on a monthly basis, but up significantly compared to last May (up 32%).

The “balance” in the Brooklyn market was especially evident in the negotiability factor, which stood just 0.3% above asking. 41% of all deals sold below asking and 21% went for above.

What’s Next

The buy signals continue to be quite strong for Manhattan. High inventory and more days on market means more sellers are willing to negotiate to get deals done. And as we enter the typically slower summer months, some sellers are likely to get even more anxious.

Additionally, the Fed recently decided not to raise the benchmark interest rate, which should result in some stability in mortgage rates. That combined with rents continuing their upward march in Manhattan means that for some buyers, purchasing may make more financial sense. This may especially be the case for folks looking for studios, 1 bedrooms and smaller 2 bedrooms.

Brooklyn is a different story, depending on what you’re hoping to buy. If you’re looking for a smaller apartment, the outlook is pretty similar to Manhattan (possibly even better if you can find something with low monthly costs).

But for larger apartments and townhouses, the picture is a bit murkier. Higher interest rates and less inventory means you’re likely to see high all-in monthly payments. But if you decide to wait on the sidelines, you run the risk of jumping back in when everyone else does. And that could likewise drive prices higher.

So what’s a buyer to do? You’d be best served by keeping your eye on the market, having a good sense of your budget, and then being ready to make a move on something that checks your boxes!

If you’re on the hunt for a new place to call home, then make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.