It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for November 2023 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for November 2023, click here. And to view stats for the previous month, click here.

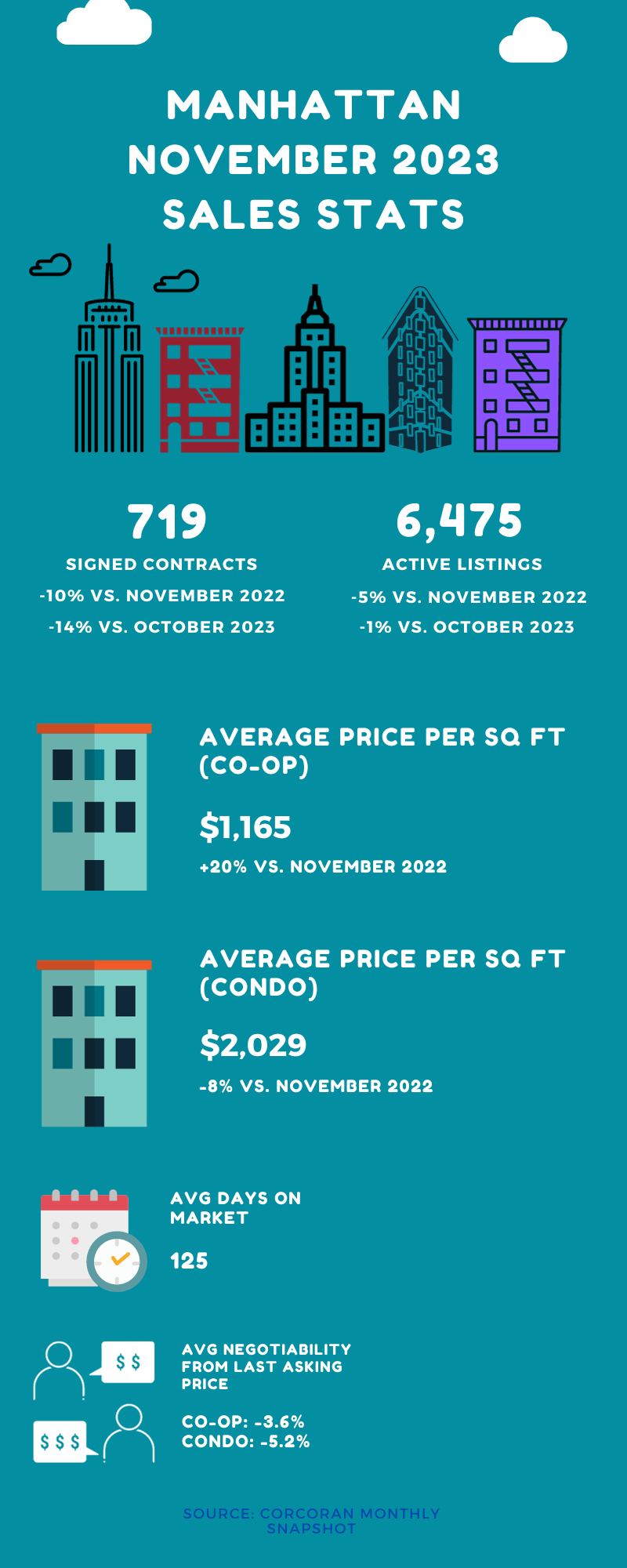

Manhattan sales activity took a tumble in the month of November, with signed contracts down 14% compared to the previous month and down 10% compared to November 2022. In fact, it was one of the lowest numbers of contracts signed in the borough since 2008.

Despite this, days on market held fairly steady as did listings on a month over month basis. So while sellers are looking at a smaller buyer pool, they’re at least not dealing with a listings pile up.

In good news for buyers, the average price per square foot was down 7% compared to November 2022. And the negotiability factor stood at 4.7% below asking, indicating that buyers are still wielding a meaningful advantage.

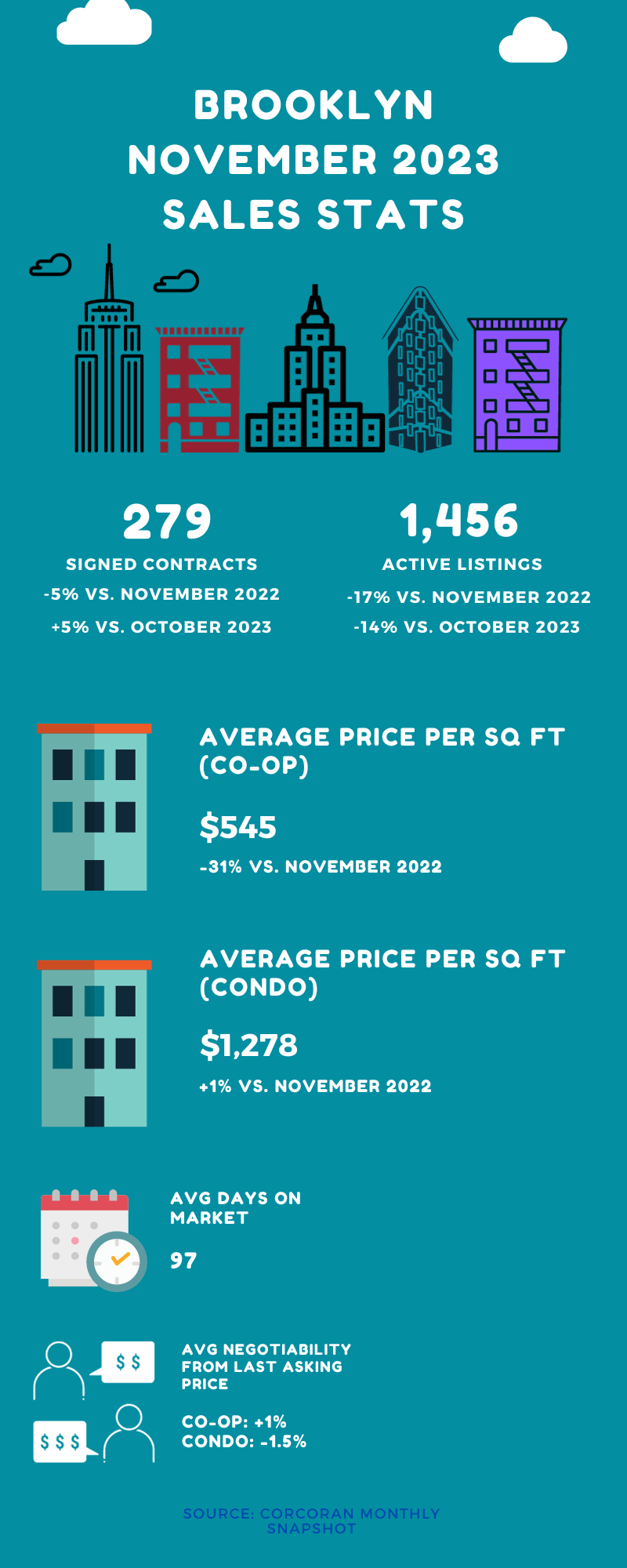

The Brooklyn sales market diverged a bit from its East River counterpart. Sales were slightly up month over month (5%) but were down on an annual basis (5%). And the decrease was one of the smallest seen in the last 20 months.

Brooklyn buyers saw no relief concerning inventory. Listings were down 14% compared to October and down 17% compared to November 2022. And that market tightening could be seen in days on market, which decreased on a monthly basis.

However, the borough still isn’t fully a seller’s market. The average price per square foot actually decreased compared to November 2022 and was flat compared to October 2023. And the negotiability factor stood at 0.5% below asking. This extend’s Brooklyn’s trend of the negotiability factor being within 1% of the last asking price for 13 of the last 16 months.

The outlook for December is a bit murky. The holiday season is likely to put a damper on sales but it’s not at all uncommon to see a rush of purchases to close out the year. So a month over month uptick wouldn’t be too surprising. Recent good news about the market plus the Fed’s decision to hold interest rates steady may also encourage some buyers. In fact, we’re already seeing some increased activity in the refinancing segment. But inventory remains stubbornly low and prices are still high for a lot of segments. So, many buyers may decide to put off buying until 2024, in the hopes that rates will go lower still.

It bears noting, however, that despite the higher interest rates, there may be prime buying opportunities out there. Rents are still quite high and in some cases, the cost of ownership is on par with the cost of renting. This is especially the case for anyone seeking a smaller apartment size, such as a studio, 1 bedroom or 2 bedroom/1 bathroom. So if that’s you, you may want to consider if home ownership in 2024 may be the right move for you.

If you’re on the hunt for a new place to call home, then make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.