It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for December 2024 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for December 2024, click here. And to view stats for the previous month, click here.

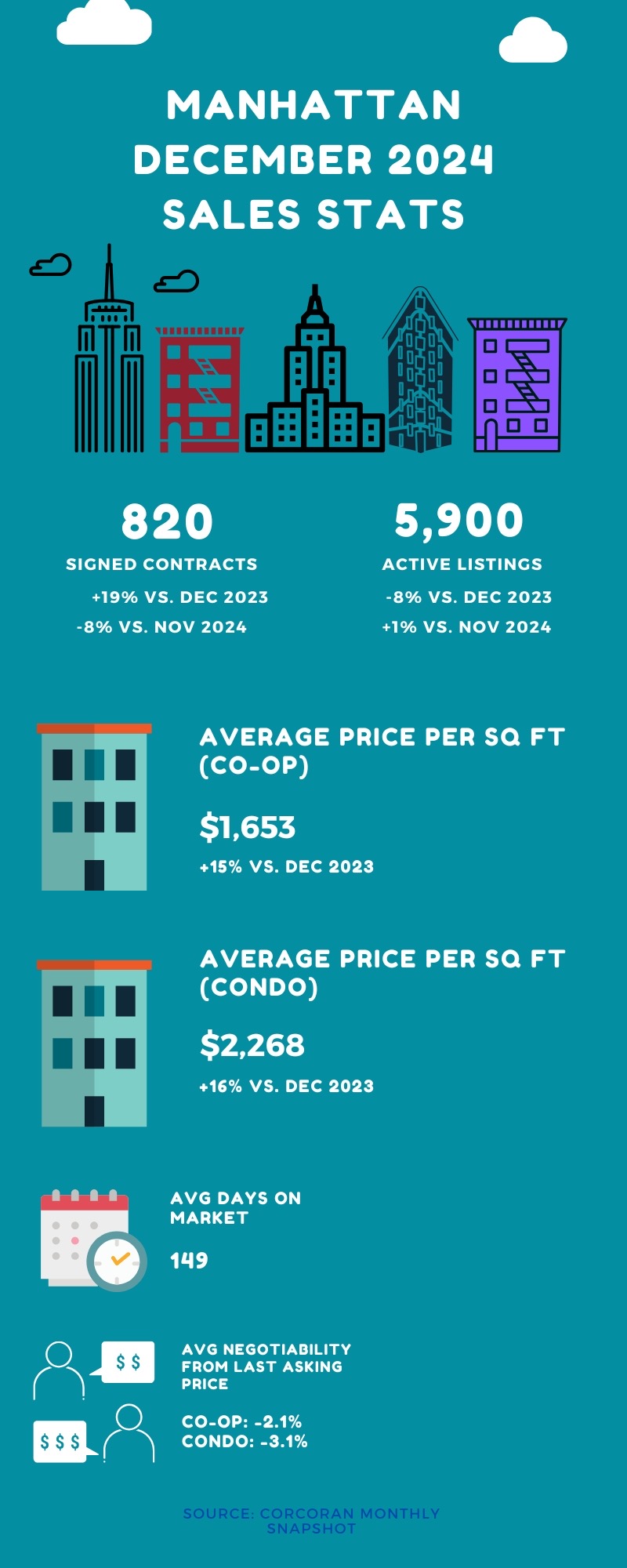

Manhattan

Signed contracts surged compared to 2023, marking one of the strongest Decembers the market has seen since December 2021. But this was still far below 2021, where we saw more than 1200 contracts signed (more than 30% below, to be precise).The strong level of deal activity led to inventory declining to 5,900 – which is one of the lowest Decembers we’ve seen since 2021 as well.

The average price per square foot saw very strong gains on both an annual and monthly basis. But this was largely due to stronger new development and luxury sales (contracts signed for over $5 million increased by 70% year over year).

Despite all of these positive indicators, it’s still not quite a seller’s market. The negotiability factor for the month sat at 2.6% below asking and at least 60% of contracts signed were below the last asking price.

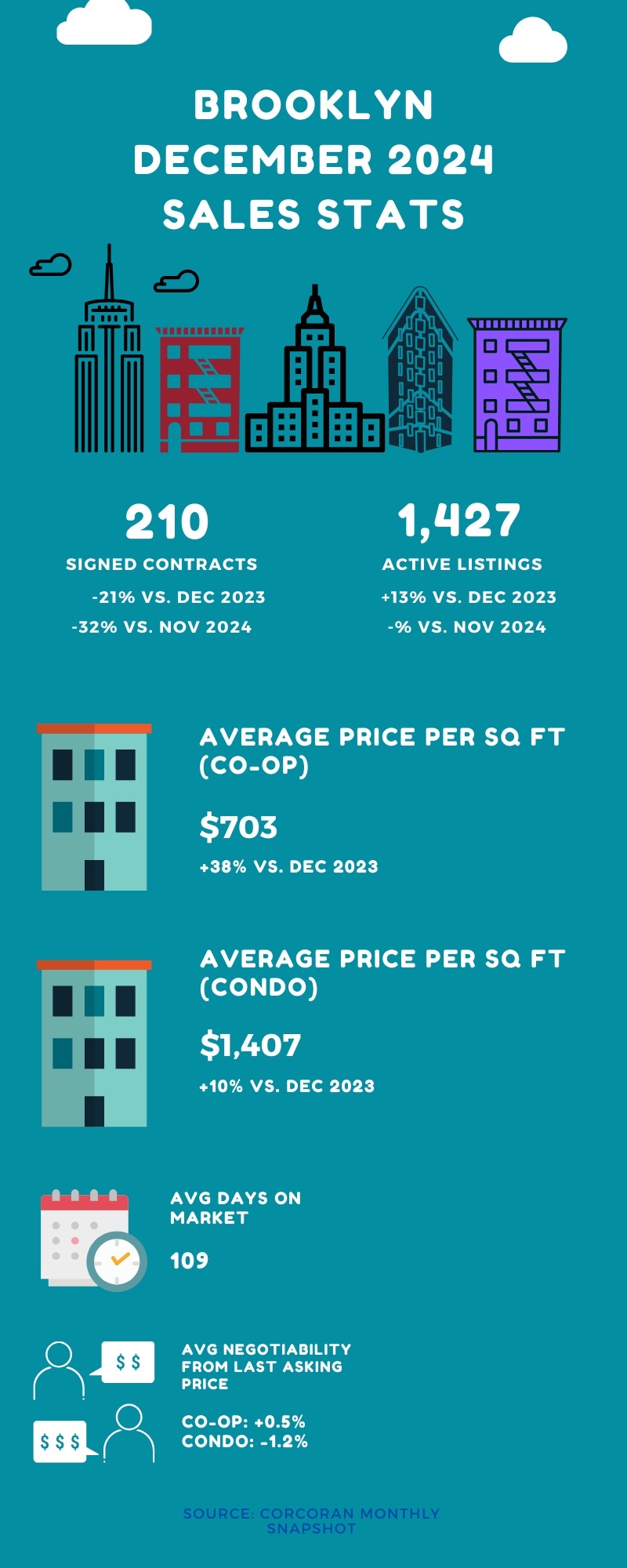

Brooklyn

By contrast, the Brooklyn sales market lost some steam, with signed contracts declining by double digits both year over and month over month. Also, in contrast to Manhattan, inventory saw an annual increase of 13% compared to December 2023. But even with this increase, it was still the second lowest level of inventory for the month of December in 8 years.

The average price per square foot jumped to a record high for the month of $1,915. But this was due to strong new development sales and far fewer lower priced sales. Home sales under $1 million declined by 33% compared to December 2023.

But like Manhattan, it’s still not an outright seller’s market. The negotiability factor stood at 0.6% below asking, which was slightly more than the previous month.

Based on early data thus far, sales for 2025 are off to a solid start. At least compared to the prior year, which was relatively weak. But it’s unclear if this trend will be sustained in light of possible headwinds.

The two biggest risks? The new administration and inflation. Both of these could cause mortgage rates to trend upwards as we close out the month. And this might cause some price sensitive buyers to pause their searches and some potential home sellers to hold off on listing their homes.

If you’re thinking of trying to own your slice of the Big Apple, make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.