It’s time to take a look at the NYC real estate market update for Q4 2024.

To view the full reports, visit the links below:

Corcoran NYC Real Estate Market Update Q4 2024 – Manhattan

Corcoran NYC Real Estate Market Update Q4 2024 – Brooklyn

Manhattan

The Manhattan market closed out 2024 with some strong stats. Although closed sales were down compared to Q3 2024, signed contracts were up by double digits both on an annual and quarterly basis.

The higher level of activity was reflected in both inventory and days on market. Inventory dropped to one of the lowest levels seen in ten years. And days on market ticked down slightly compared to the prior year. Lower interest rates and renewed optimism about the market likely spurred all the activity.

However, buyers remained value conscious. The median price fell by 4% compared to both Q3 2024 and Q4 2023. And the average price per square foot notched a decline of 2%.

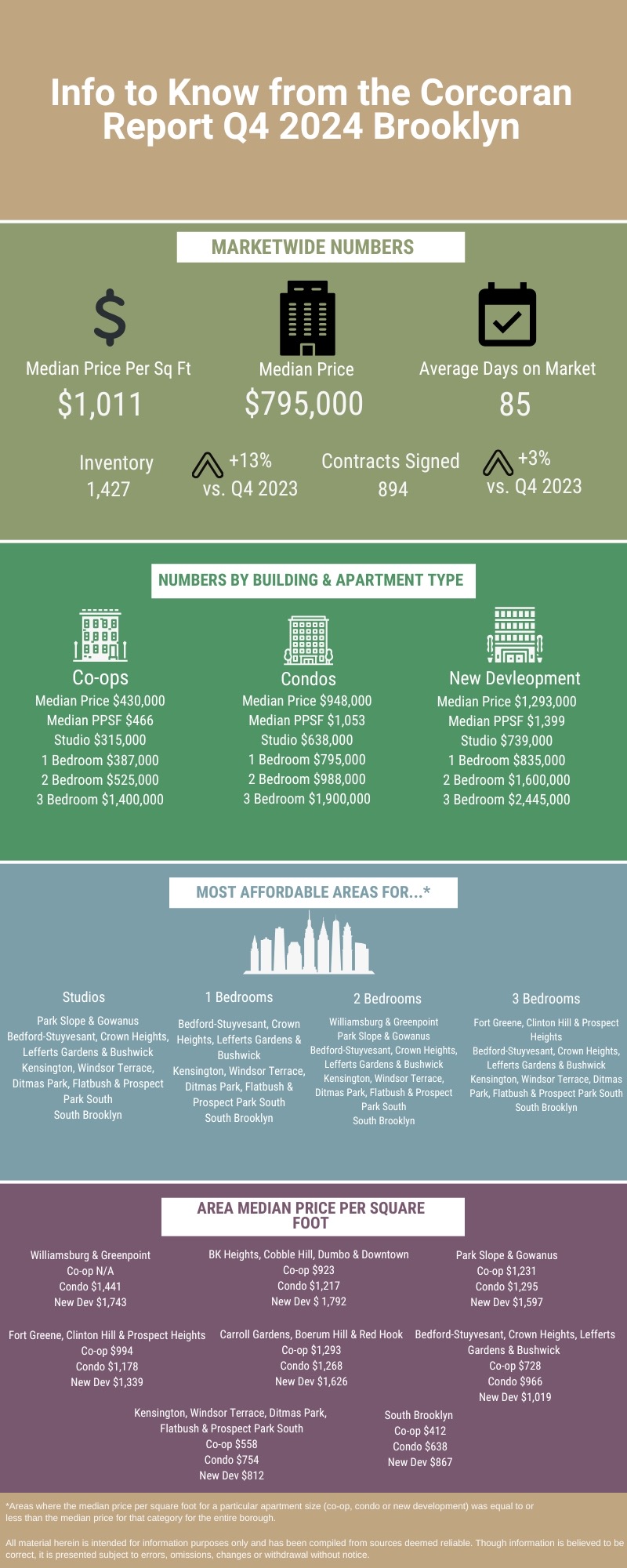

Brooklyn

The end of the year was a bit more mixed for Brookyn. But the signs were mostly positive.

Contracts signed were up on an annual and quarterly basis, but not at the same levels seen in Manhattan. And closed sales were down compared to the prior quarter and prior year.

Although inventory declined compared to Q3 2024, it was up by a solid 13% compared to last year during the same time period. A welcome respite for buyers, but still a ways below historical averages.

The overall average price per square foot saw some gains on both an annual and quarterly basis. And although the median price was flat compared to Q3 2024, it was up 9% compared to the prior year.

With a new administration starting, uncertainty about where sales are headed this year has started to seep into the market. (You can check out my personal predictions for NYC real estate in 2025 in this blog post.)

The key things to watch will be inventory and interest rates.

Inventory has already been steadily rising which is pretty typical of market seasonality. But it’s unclear how high it will go as we move through the winter.

How high inventory rises will largely depend on what happens with interest rates. If they stay relatively steady or notch downwards, we may see a stronger showing for inventory. But if they go higher, then we’re likely to see fewer listings than in years past. And if inventory is disappointing, that combined with higher interest rates will keep more buyers on the sidelines.

At least that will be the case for the next month or so. Rents have been showing a lot of resilience (especially in Manhattan). And if they start rising again, then that might put some pressure on buyers to look into homeownership.

Thinking about buying but not sure if you’re ready? Then sign up for my First Time Buyer Bootcamp to help you figure it out! Join here!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.