It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for January 2025 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for January 2025, click here. And to view stats for the previous month, click here.

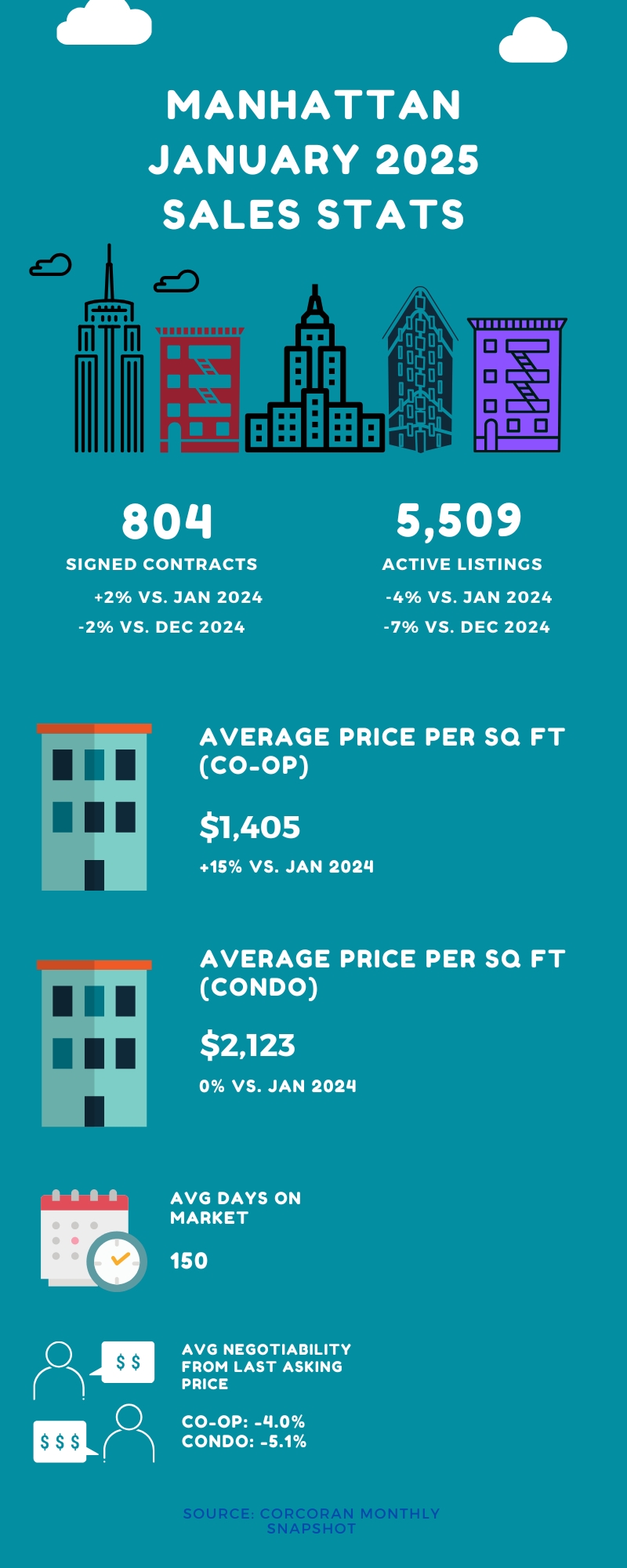

Manhattan

Contracts signed were up modestly compared to last year, up just 2%. This was the smallest increase seen in the borough since August 2024. This indicates that the market rally that we saw at the start of the fall petered out a bit by the end of the year.

Prices were down by 12% compared to December 2024 but this steep decline was caused by fewer high end luxury sales. And surprisingly, inventory was down in Manhattan on both an annual and monthly basis. In fact, it was one of the lowest levels we’ve seen in January since 2017.

The cooling of the market was further reflected in the negotiability factor, which stood at 4.5% below asking. So even though buyers didn’t have as many options, they still held quite a bit leverage over sellers.

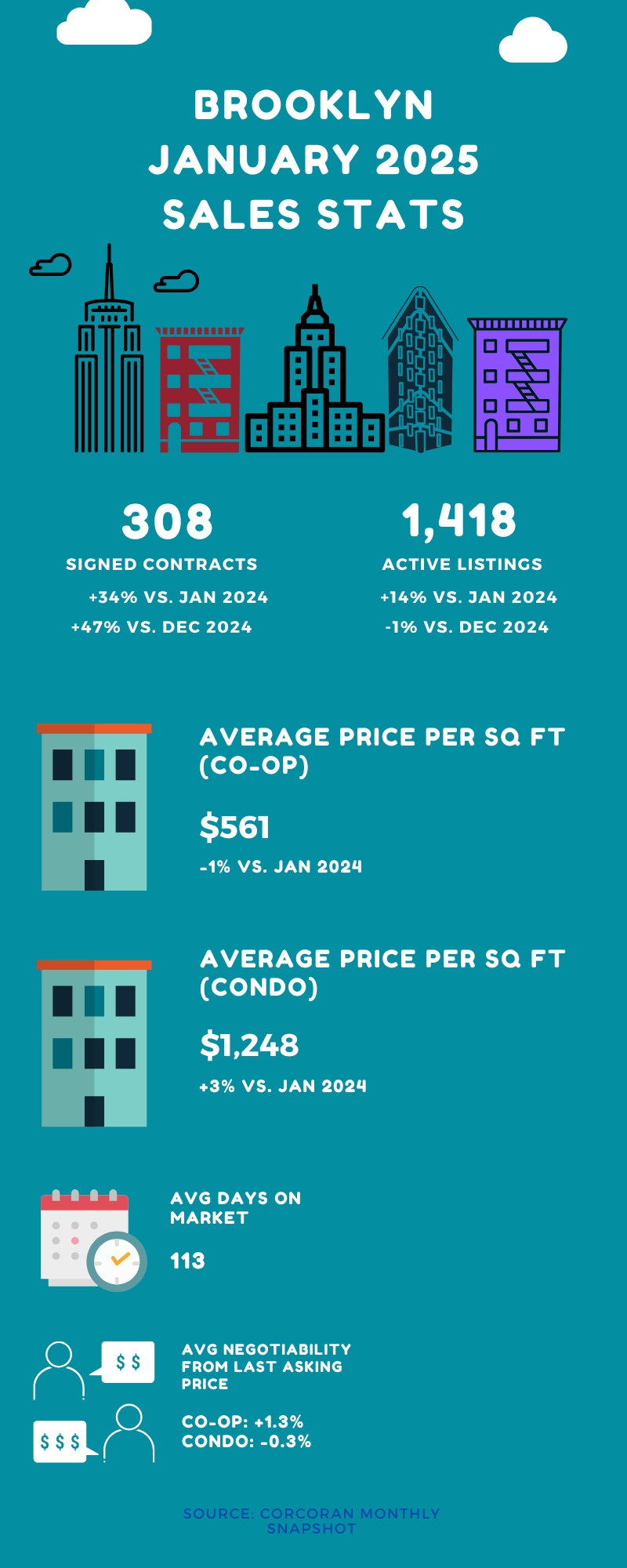

Brooklyn

Things were completely different across the East River in Brooklyn. Signed contracts were up an impressive 34% compared to January 2024 and up 47% compared to December 2024.

And while the average price per square foot saw a double digit decline compared to December 2024, this wasn’t necessarily bad news. The decline was caused by a big jump in contracts signed below $1 million.

In good news for buyers, inventory was up 14% compared to last year. But the market remains challenging for them. This was still one of the lowest levels of listings in 8 years. And the negotiability factor stood at 0.4% above asking.

With some of the new administration’s sweeping proposed tariffs off the table (for now, at least, and only some), mortgage rates have started to stabilize and even trend downwards. And February is the month where we typically start to see the beginning of the upward trend in inventory in the lead up to the spring sales market. So those factors may combine to result in some increased sales for the month of February.

But many are feeling the effects of the instability that the last few weeks has brought. And the Fed has indicated that there won’t be any more interest rate cuts for a few more months, at least. So it wouldn’t be surprising if a number of buyers (and sellers) hit the pause button as they wait to see what economic policies may or may not move forward.

If you’re thinking of trying to own your slice of the Big Apple, make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.