It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for March 2025 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for March 2025, click here. And to view stats for the previous month, click here.

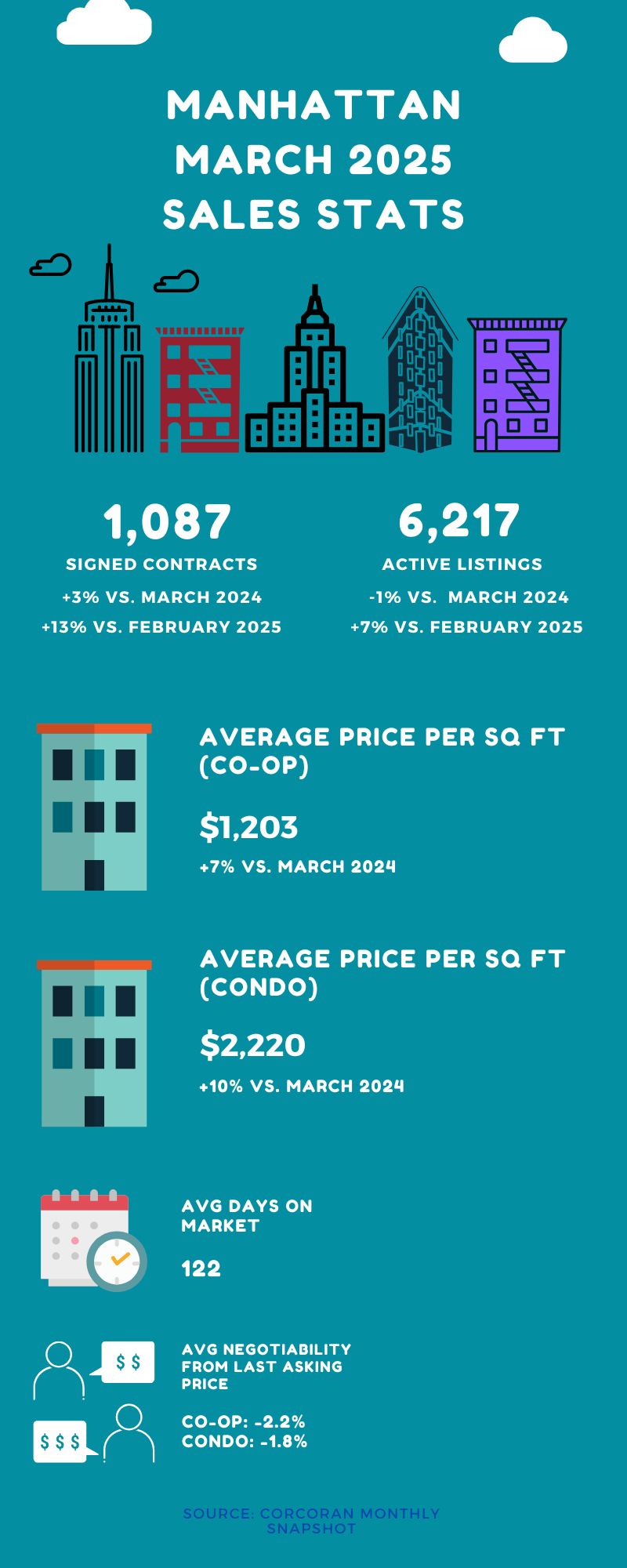

Manhattan

The Manhattan market saw annual and monthly gains in contracts signed. In fact, this was the 10th month in a row that signed contracts increased on an annual basis.

In welcome news for sellers, the average price per square foot was up compared to February and also compared to March 2024. Much of this gain was caused by a higher number of sales with asking prices above $2,500 per square foot compared to the previous month.

However, there’s some signs that buyers are starting to lose some of their leverage. The negotiability factor stood at 2.0% below asking, compared to 3.0% the prior month.

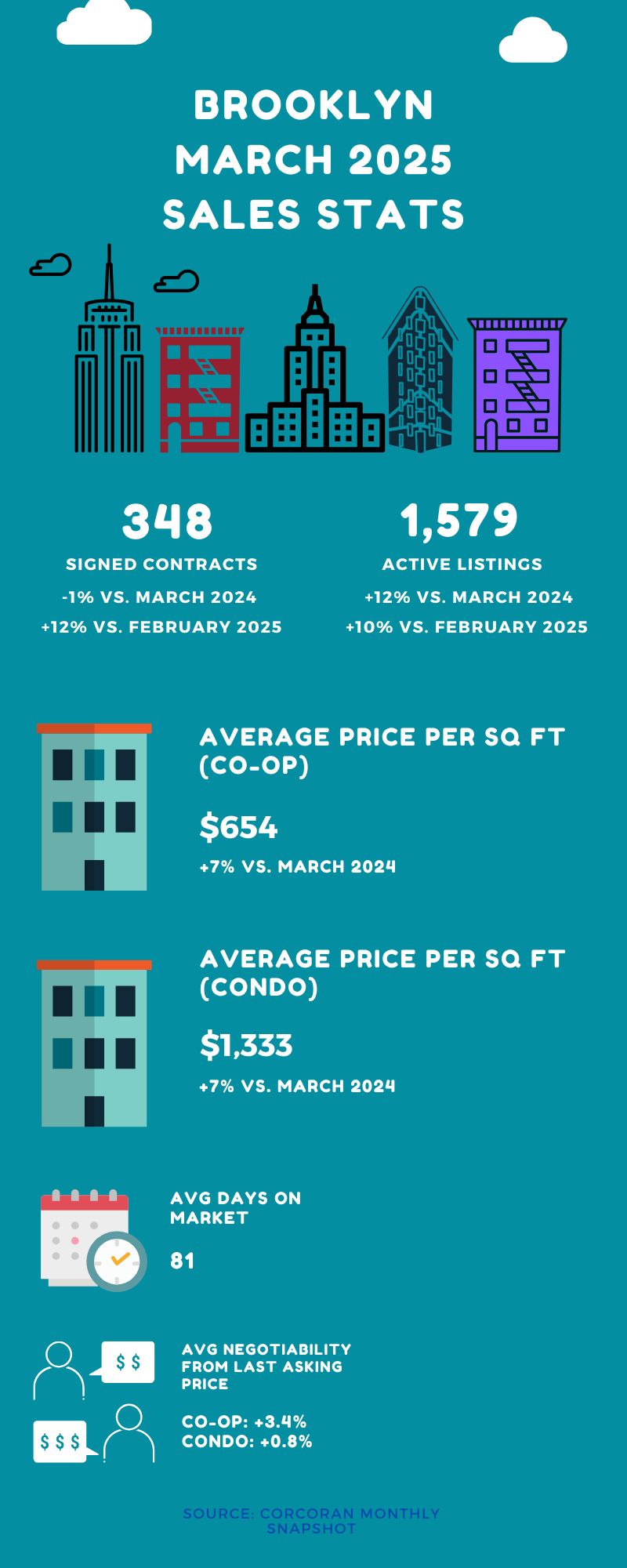

Brooklyn

Signed contracts were about even with the prior year. But they increased on a month over month basis, in line with typical seasonal trends. Although the average price per square foot was down slightly compared to February, they were up on an annual basis.

In some positive news for buyers, inventory was up by 10% compared to the prior month. However, it was the second lowest level of inventory for the month of March in the last eight years.

And that market tightness was reflected in the negotiability factor. It was at 1.8% above the last asking price.

With tariffs roiling the markets, we’re currently in uncharted territory. What’s particularly worrying is that the bond market has been performing a bit poorly. And mortgage interest rates are much more closely tied to treasury bills than they are to the Fed’s benchmark interest rate.

As a result, mortgage interest rates stunned buyers (and sellers) a bit when they spiked upwards earlier this month, edging close to 7%. While they’ve since come down to lower levels, jitters remain.

And speaking of the Fed interest rate – they’re in a bit of a bind in terms of what they can do. Tariffs threaten inflation which the Fed wants to curb, but there’s also the double whammy of the risk of a recession. So they may not be able to be as aggressive as they’d like with interest rate cuts.

All this uncertainty may mean both sellers and buyers may pull back a bit. And that could throw cold water on the spring sales market. For the time being, a number of tariffs have been paused which may be enough of a reprieve for some to move forward with their housing plans. But we’ll have to wait for April’s numbers to play out to get a true sense of how folks in the market are actually feeling.

If you’re thinking of trying to own your slice of the Big Apple, make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.