It’s time to take a look at the NYC real estate market update for Q1 2025.

To view the full reports, visit the links below:

Corcoran NYC Real Estate Market Update Q1 2025 – Manhattan

Corcoran NYC Real Estate Market Update Q1 2025 – Brooklyn

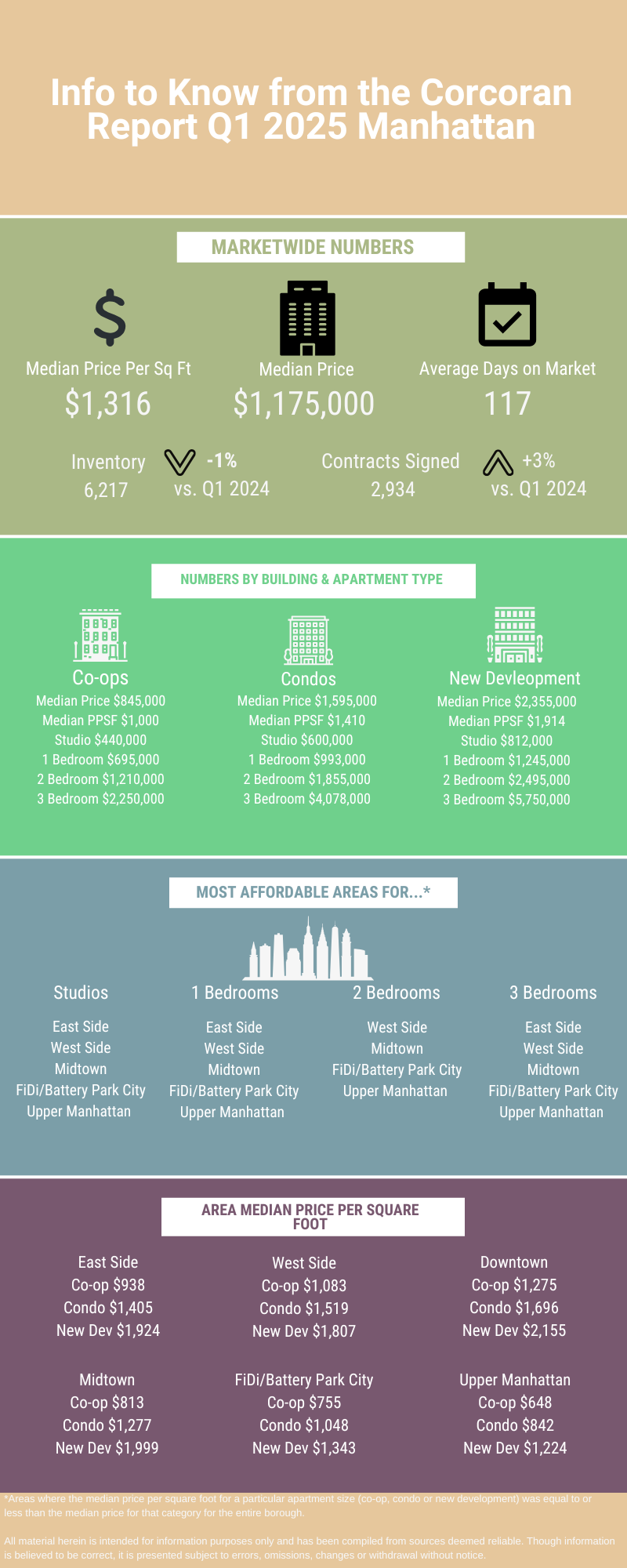

Manhattan

Most indicators in the Manhattan sales market were quite positive to start off the year.

While closed sales and the average price per square foot were both down compared to Q4 2024, all other metrics were up on both an annual and quarterly basis. This was just the fourth time in 20 years that this has happened at the start of the year. Of particular note were closed sales (which were up 14% compared to last year) and the median price (which was up 12% year over year to $1.175 million).

The overall price per square foot for the borough improved thanks to a combination of improved demand and lower inventory. In fact, new listings were at some of the lowest levels we’ve seen in 11 years during the first quarter. And this helped to drive down days on market by 8% compared to Q1 2024.

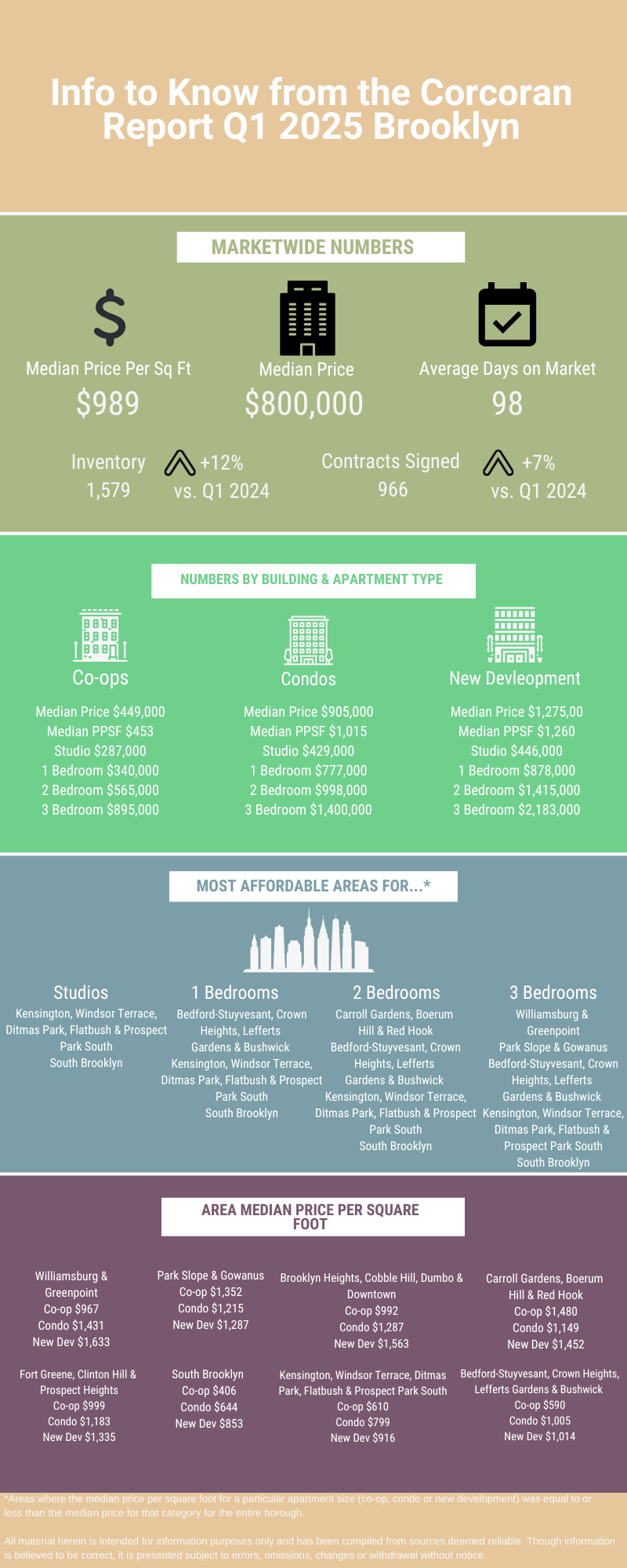

Brooklyn

The Brooklyn sales market also got off to a solid start, but the indicators were a bit more mixed.

Unlike Manhattan, closed sales were down on both an annual and quarterly basis, down to a 12 year low. This reflected the challenging low inventory market from the preceding months.

However, signed contracts were still up compared to Q1 2024 and Q4 2024. And although inventory remained 17% below typical levels, buyers saw some much needed relief thanks to double digit gains in listings both year over year (12%) and quarter over quarter (11%).

Strong demand helped to push the median price higher, up to $800,000 for the entire borough. This was the second highest level seen since Q2 2022 (which was just before interest rates started marching upwards).

Anecdotally, the spring sales market has been behaving as we might expect. Inventory has been steadily increasing and we’ve been seeing month over month increases in signed contracts so far.

But markets were thrown into a tailspin due to the U.S. administration’s tariff policies (much of which still remains unclear). And dueling concerns about a recession and inflationhave put the Fed in a tough spot. It’s unclear to what degree buyers (and sellers) will pull back from the market in light of this news. Much of this is all still playing out and will continue to do so for weeks to come.

It’s very likely that many would-be buyers will be too nervous to enter the market – especially if they’re rattled by what’s happened to their stock portfolios. But this could in turn push up rents (which have already been unusually high). So some buyers might decide that the risk is worth it and just keep forging forward. Sales figures from mid April to mid May will be particularly telling.

***

Thinking about buying but not sure if you’re ready? Then sign up for my First Time Buyer Bootcamp to help you figure it out! Join here!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.