Welcome back to my series “How Much Does It Cost to Own”!

Each month, we’ll be looking at different sized apartments to get a sense of what the “median” apartment in either Manhattan or Brooklyn would cost. This series should give you an idea of whether or not you’re in the “ballpark” for the kind of apartment you might want.

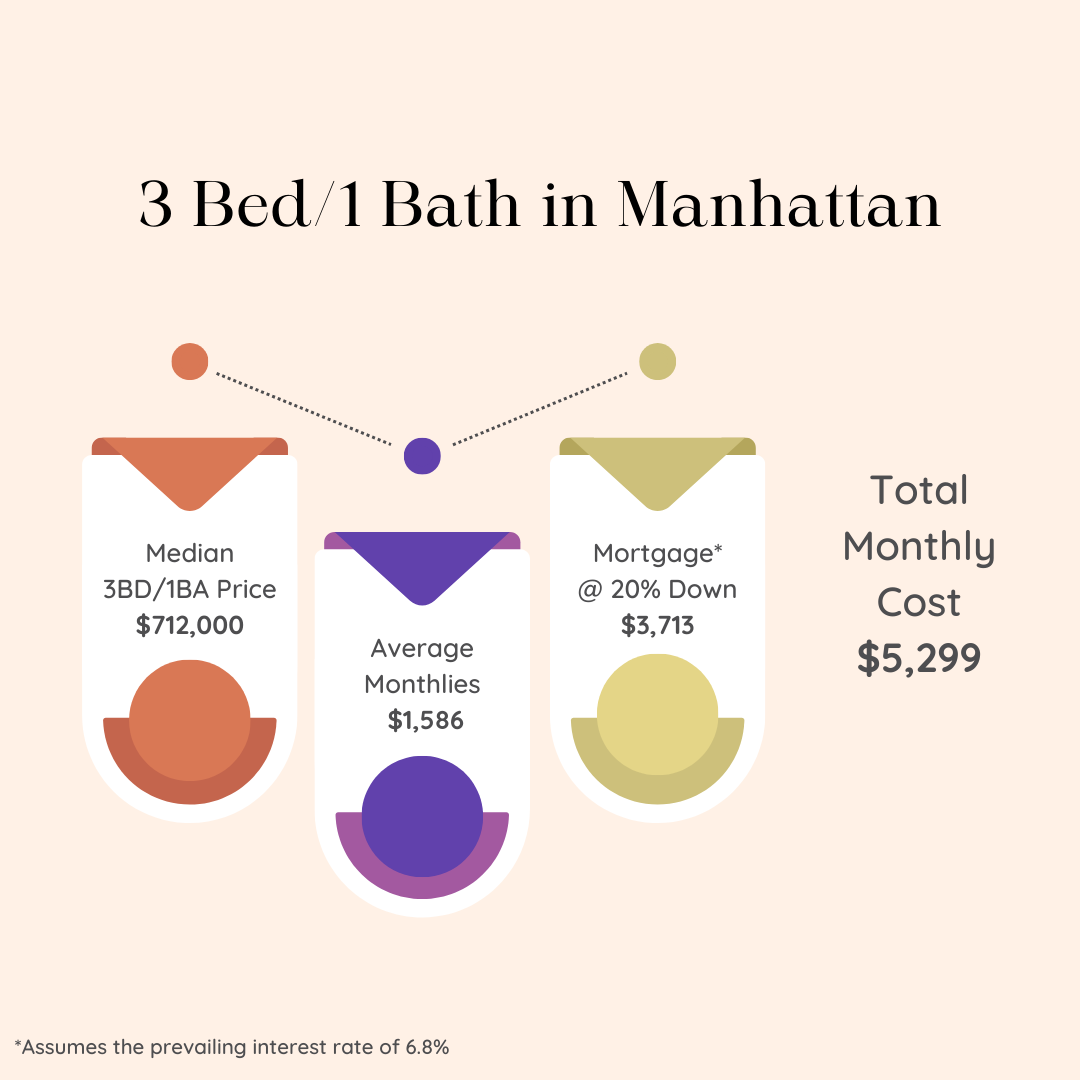

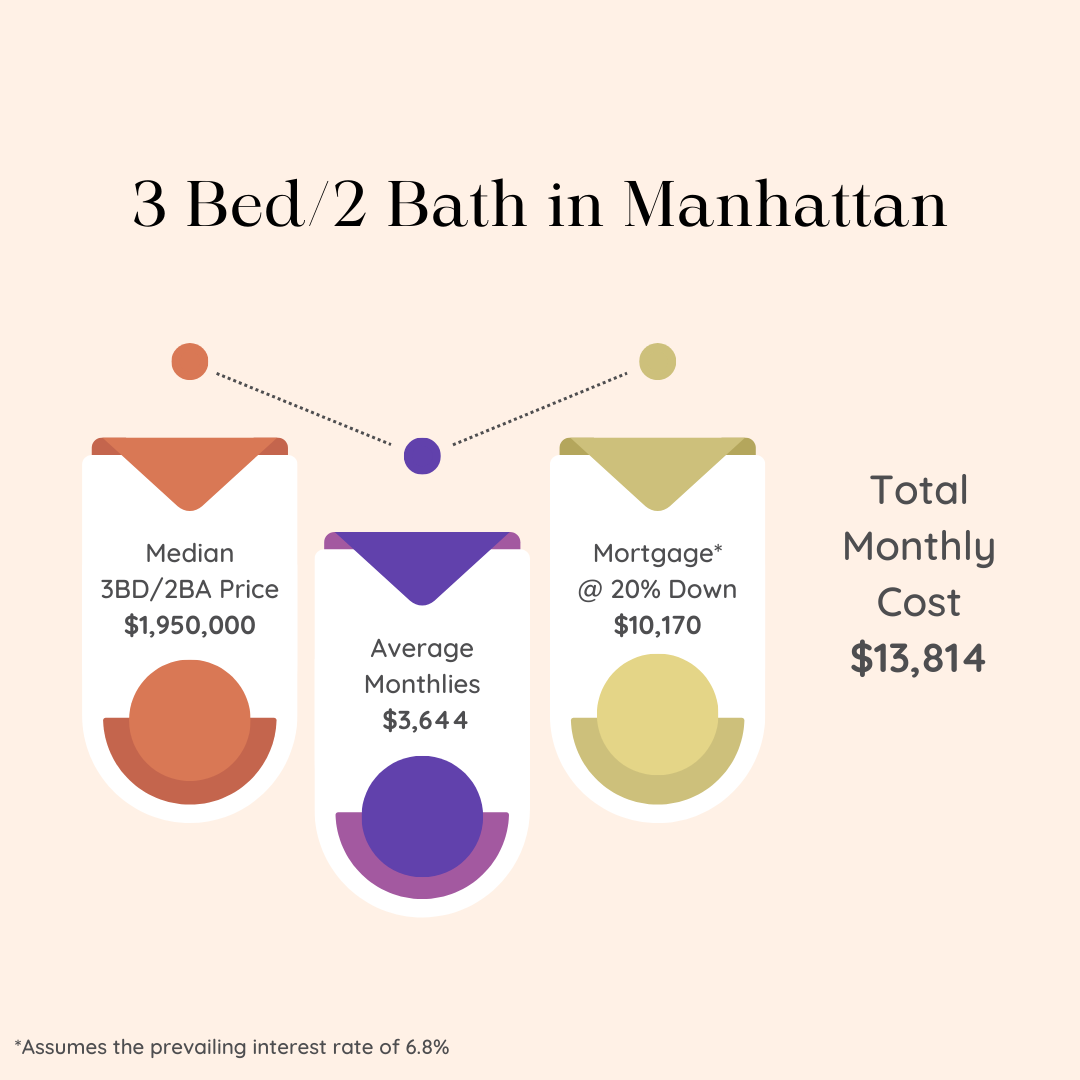

Keep in mind that these figures represent the median for all building types. So coops, condos, walkups, elevators, doorman and non-doorman, amenities, no amenities, new development – they’re all looped in together.

So let’s turn our attention this month to 3 bedrooms!

Next to 2 bedrooms, 3 bedroom properties are some of the most in demand properties in the city (and sometimes even in more demand, depending on the area). But they also have wide variations in pricing due to differences in square footage and bathroom counts.

So for that reason, this edition has four rather than two infographics. But keep in mind that 3 bed/2 bath stats are being heavily skewed by luxury new developments. So don’t be too discouraged by the pricing for those!

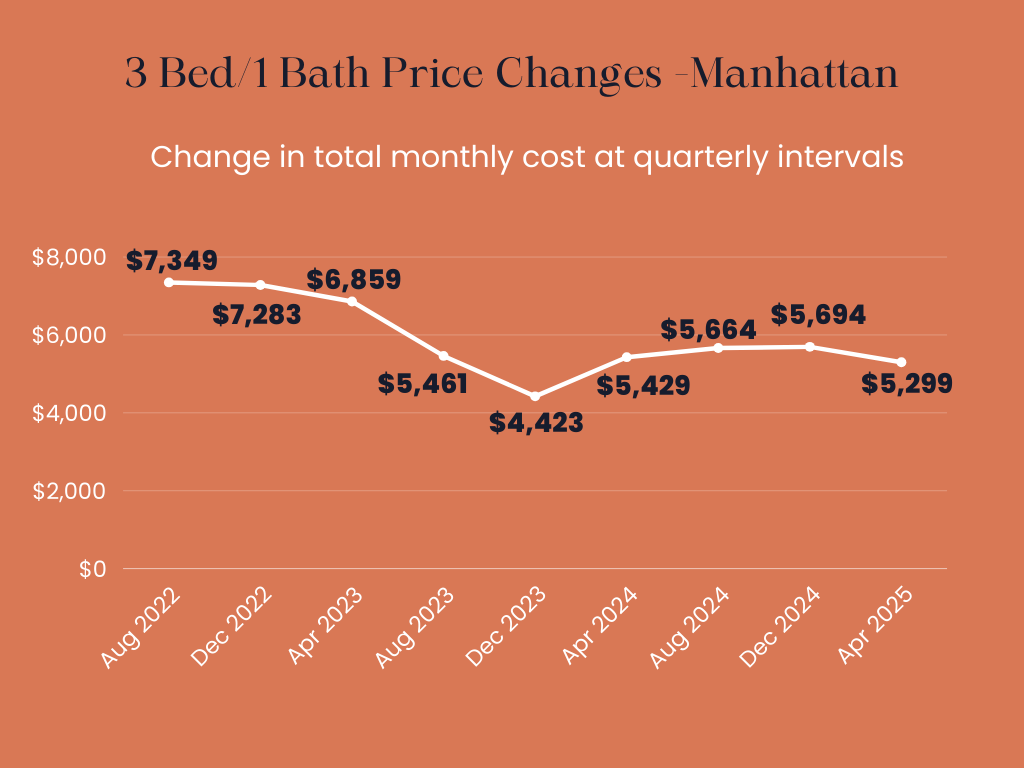

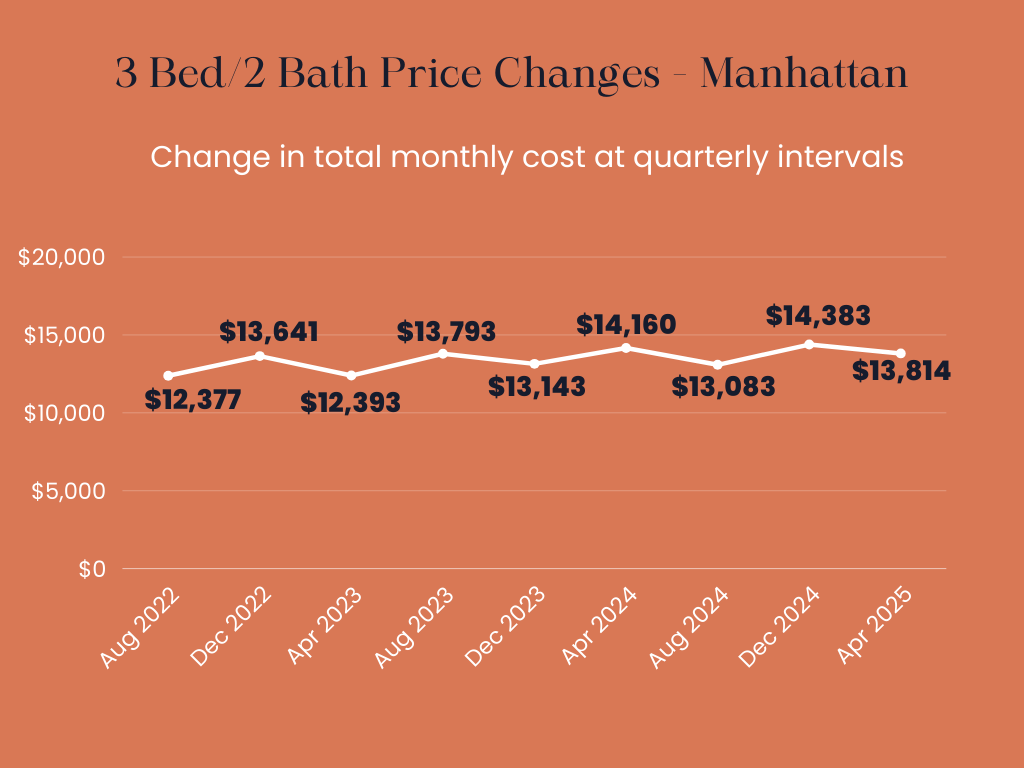

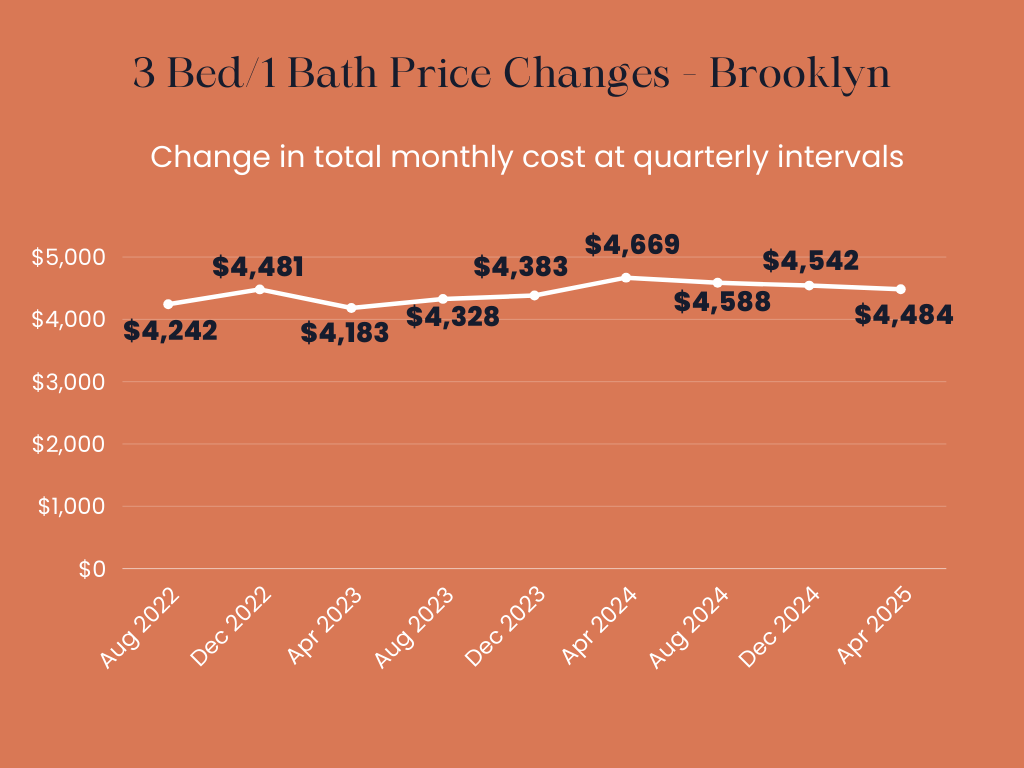

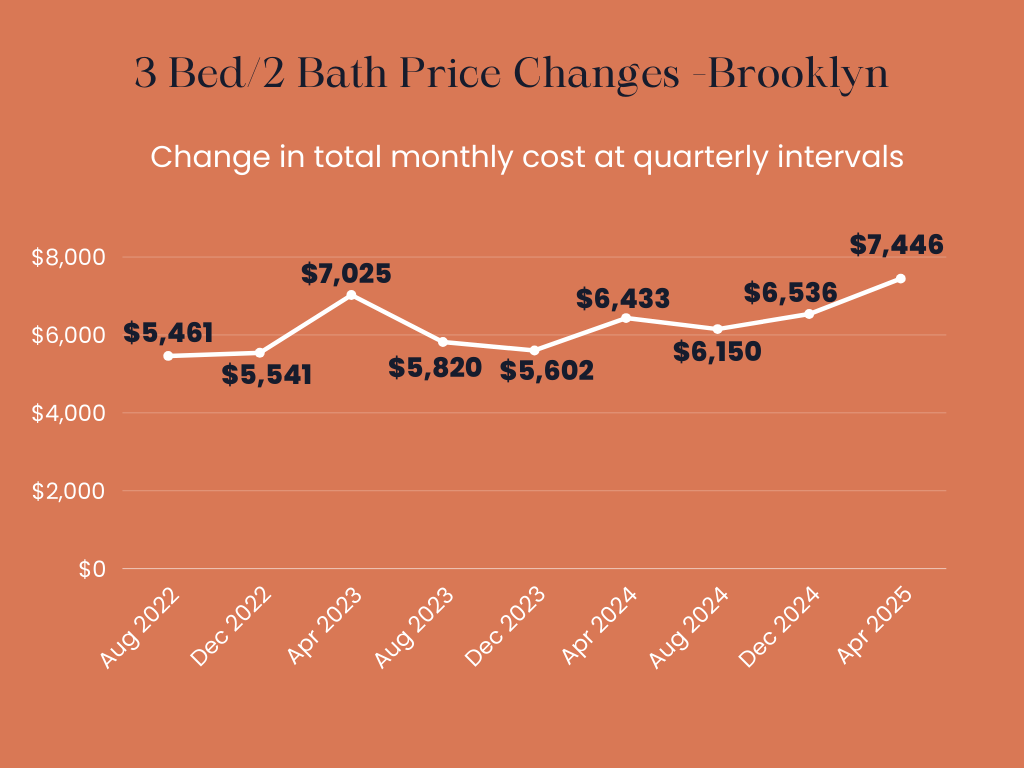

Now let’s get a visual on how median price and total monthly costs have shifted over time.

Thanks to lower asking prices, the cost of owning a three bedroom either with 1 bathroom or 2 bathrooms in Manhattan is down compared to December 2024.

Monthly carrying costs remain roughly the same for 3 bed/1 bath apartments and they’re up slightly for 3 bed/2 bath apartments. These two factors offset slightly higher interest rates compared to the prior period (6.8% versus 6.75%)

We see a similar story playing out in Brooklyn for 3 bed/1 bath apartments. Asking prices are lower compared to December 2024 and so are average monthly carrying costs. So these two are keeping downward pressure on prices despite higher interest rates.

3 bed/2 bath apartments are bucking the overall trend, however. Asking prices, average monthlies and higher interest rates all caused the cost of ownership to jump by $910 compared to the prior period. What was behind the jump? More luxury listings in higher priced areas, which one would expect since we’re in the midst of the spring sales season.

The rent versus buy equation works out the same in both boroughs. If you’re willing to have just 1 bathroom, then owning makes sense. It’ll save you a whopping $6000 in Manhattan and $2,195 in Brooklyn.

But there are big caveats for both areas.

Most of the 3 bed/1 bath inventory in Manhattan is uptown, and uptown has quite a few HDFC apartments which are always priced below market due to income restrictions. And most of the 3 bed/1 bath inventory in Brooklyn is in South Brooklyn. So as I always recommend – you should assess whether or not renting or buying makes more sense on a neighborhood by neighborhood basis. Don’t just go based on these boroughwide numbers.

For 3 bed/2 bath apartments, renting makes more sense. The price difference is $1,873 in Manhattan and $767 in Brooklyn.

But here’s yet another important caveat. This is one of the narrowest differences we’ve seen between renting and buying for 3 bedrooms in both boroughs. The reason? Rents keep climbing at a surprising pace and a shortage of inventory (in particular in Manhattan) means it’s likely to continue into the busy summer rental season.

So if you’re thinking about owning a place and you plan on staying in it for a long time period (think 5 to 7 years), ownership may make more long term sense.

Want to see how the rent versus buy equation works out for specific areas? Get in touch with me! I’ll create a customized report just for you.

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.