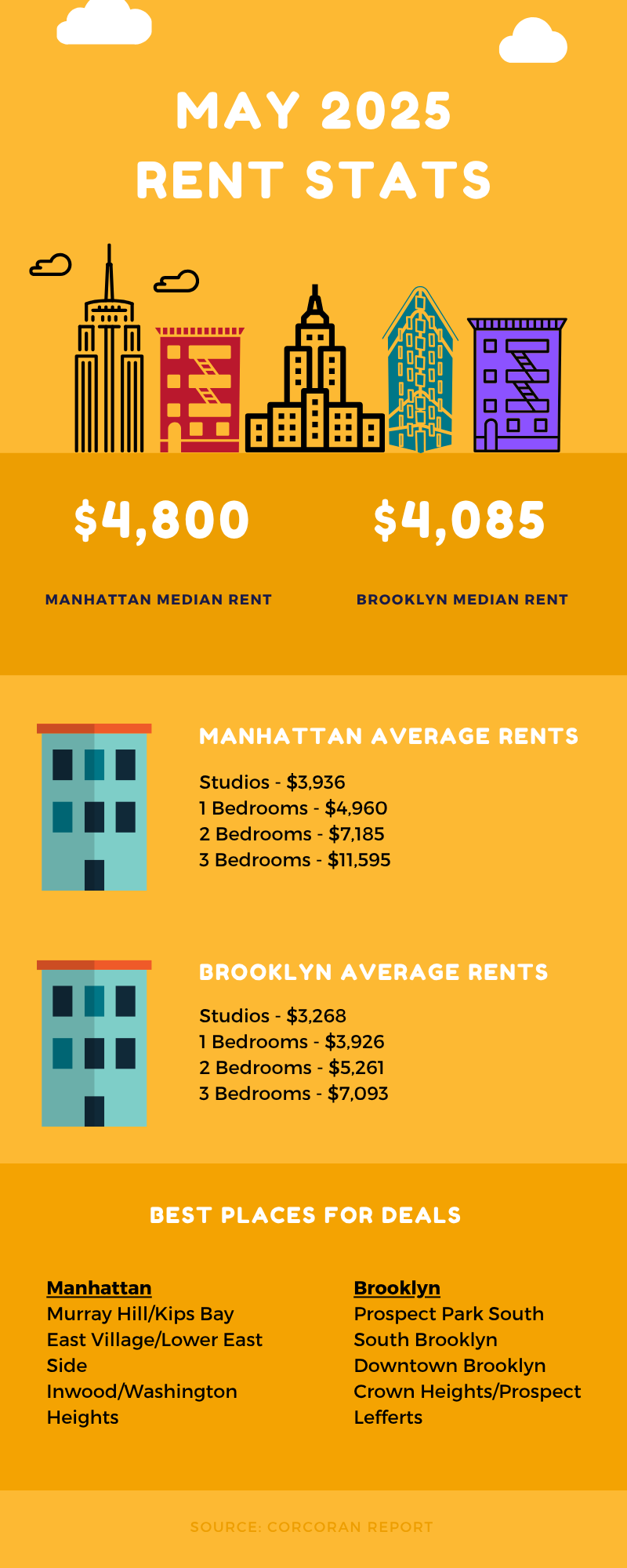

Here’s a quick snapshot of the NYC rental market for May 2025, with a focus on Manhattan and Brooklyn. You can view stats from the previous month here.

Note that the areas for “best deals” are determined by a combination of vacancy rates and/or areas with price declines (or lowest price increases, in the event of a rising market) across the most categories of apartment types. Keep in mind that “best deals” doesn’t necessarily mean “cheapest.” It just means places where you’re more likely to have some bargaining power and/or more options.

Leasing activity fell short for the month of May in Manhattan. Lease signings were up compared to April which was in line with typical seasonal trends. But they were down by double digits compared to last year. In fact, this was one of the lowest levels of leasing activity for the month of May seen in the borough since 2021.

Renters did get a little bit of a break. Even though rents increased a jarring 7% compared to May 2024, they were flat compared to April 2025. It was little comfort though because this was still a record high level. And what’s more concerning is that inventory declined compared to April which is the opposite of what we’d expect for this time of year.

Brooklyn saw the same pattern with lease signings. There was a sharp tumble compared to May 2024 but a solid uptick compared to the prior month. Rents stayed even with the prior year, but were up slightly compared to April, hitting a new record high.

However, the listings situation in the borough was far more encouraging compared to Manhattan. Listings were up by 3% compared to the prior year and a whopping 14% compared to April. This, in contrast to what happened in Manhattan, is exactly the kind of increase we’d expect to see for this time of year.

We’ll probably see more of the same in the Manhattan rental market and possibly worse. The lack of new inventory in May was quite surprising and doesn’t portend well for the busy upcoming summer season. We should still see month over month increases simply because of the sheer number of leases that turn over for this time of year. But we may be in for much lower rates compared to prior years. And that could make for an ultra competitive market, the likes of which we haven’t seen in some time.

The situation is likely less dire in Brooklyn overall. Inventory is gradually growing and at levels higher than what we saw back in 2022 and 2023 for this same time of year (it’s about even with 2024). So renters will have options. But because of high mortgage interest rates, more options means buyers will continue to rent. So the pool of renters is higher than it might be in a healthier sales market.

This market is going to be really, really hard, especially in Manhattan. Preparation is key, especially these days! Here’s a video reminder of what you need in order to put your best foot forward – NYC Apartment Hunting Tips – The Key to Getting An Application in FAST.

To get the full NYC Rental Market Update for May 2025, click here.

And if you’re thinking about getting a new rental in NYC, then check out my Renter Resources page and get my FREE guide to renting in NYC when you join my email list!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.