It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for July 2022 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for July 2022, click here. And to view stats for the previous month, click here.

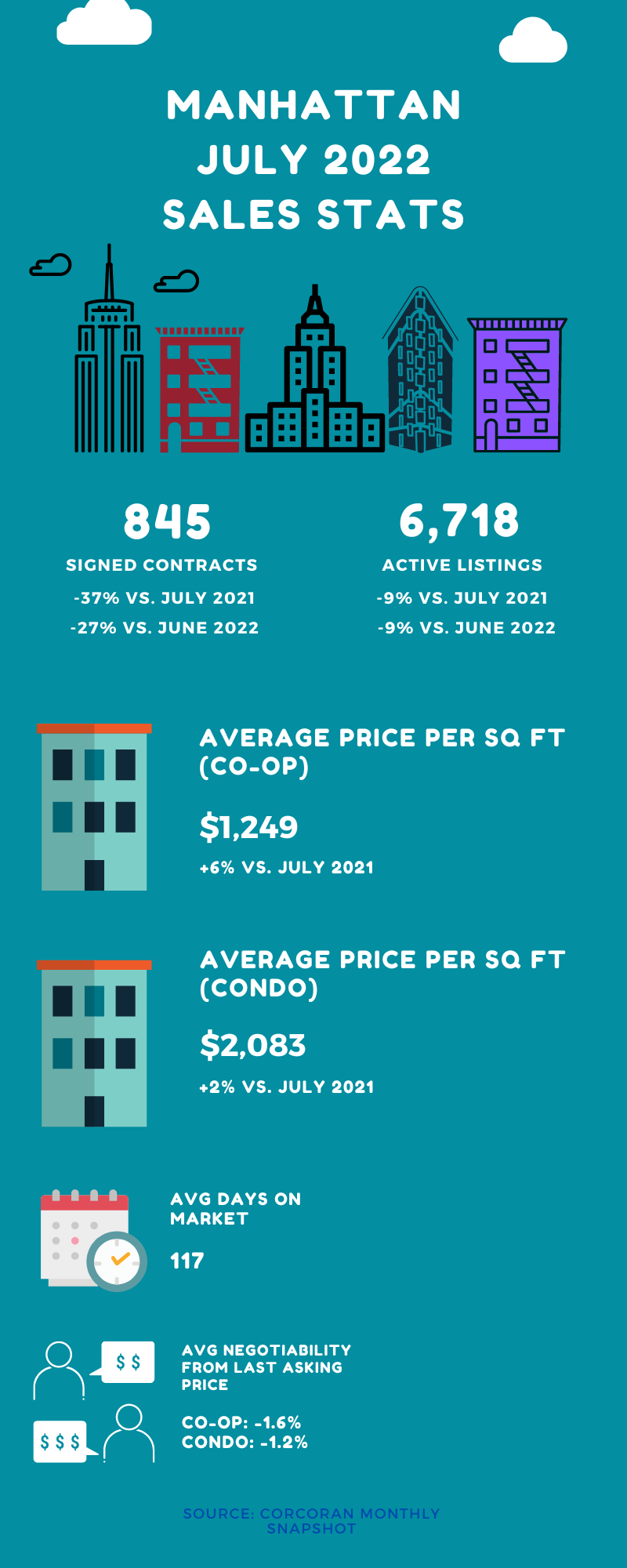

Not surprisingly, contracts signed were down both year over year and month over month in Manhattan. And the slides were pretty substantial (37% versus July 2021 and 27% versus June 2022).

But market activity in the borough isn’t necessarily sluggish. Days on market decreased year over year. Average price per square foot continued to climb year over year (thanks to new development and high end sales). And inventory decreased compared to last year, meaning there isn’t a “glut” of homes currently for sale.

Buyers in Manhattan continued to hold a bit of an edge, however, with the negotiability factor sitting at 1.5% below asking price.

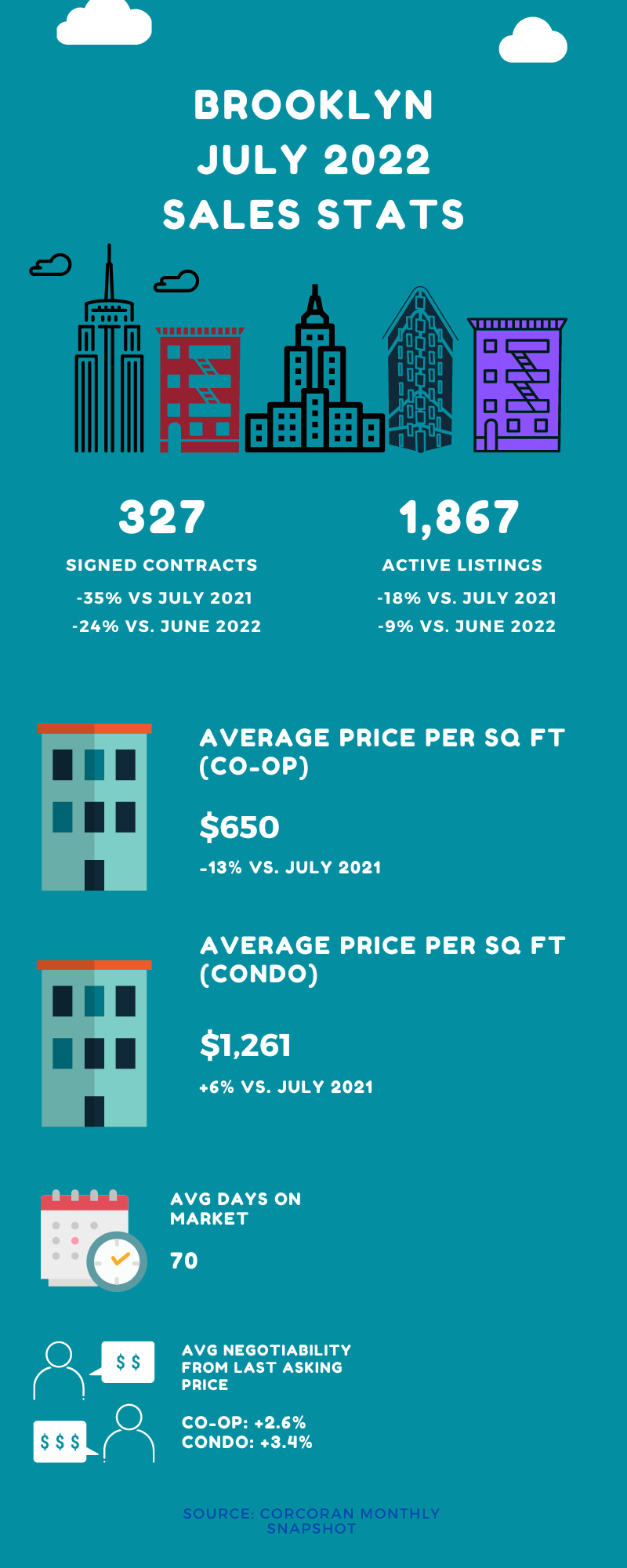

In Brooklyn, sales were also down both month over month and year over year at similar levels as seen in Manhattan (35% versus July 2021 and 24% versus June 2022).

But like its East River counterpart, days on market were down versus the previous year. Average price per square foot was up, albeit more modestly. And active listings decreased by quite a bit (18%, in fact) versus July 2021.

And this translated into sellers continuing to have just a bit of the upper hand over buyers, with the negotiability factor standing at 1.3% above asking price.

A sales market shift is certainly underway, especially with respect to the overall volume of transactions. But decreasing inventory is likely preventing price growth from coming to a halt. At least, for now.

The market recently got somewhat better news with respect to inflation, but the Fed is still expected to raise rates. And while we can’t be sure by how much mortgage interest rates will rise (given a surprise decrease recently), they seem likely to go higher for at least the next 4 to 6 months.

If you’re on the hunt for a new place to call home, then make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.