It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for August 2022 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for August 2022, click here. And to view stats for the previous month, click here.

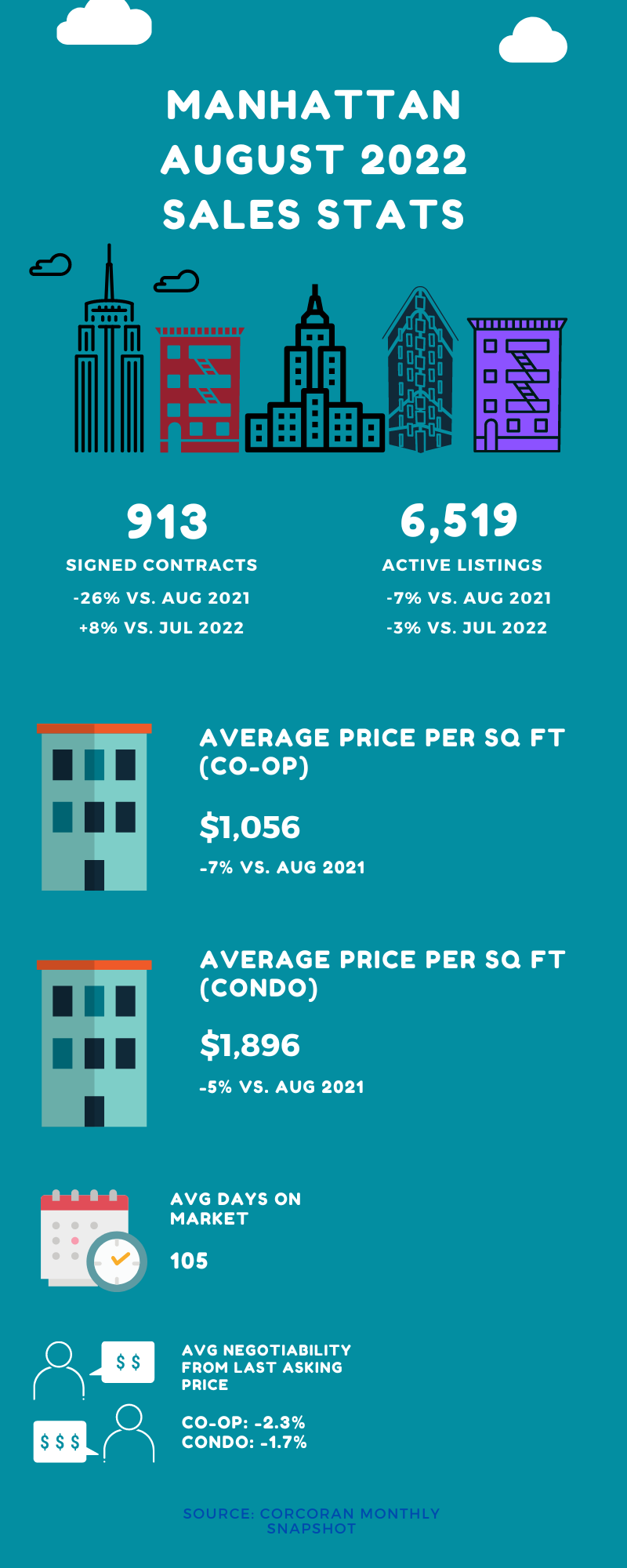

Contracts were down sharply year over year in Manhattan, continuing a downward trend in market activity. But they were surprisingly up just a bit month over month. And sales were still higher during the month compared to August 2019.

Prices also finally took a downward turn, but not by much. While the change was pretty marked versus July (down 10%), it was quite minimal year over year (down 0.2%).

Other metrics for the market were more positive. Days on market declined, indicating continued buyer interest and better pricing on the part of sellers. And sellers also clearly weren’t pressed to list their homes for sale. Inventory was down both year over year and month over month.

But things are edging more in favor of buyers – the negotiability factor stood at 2.2% below asking.

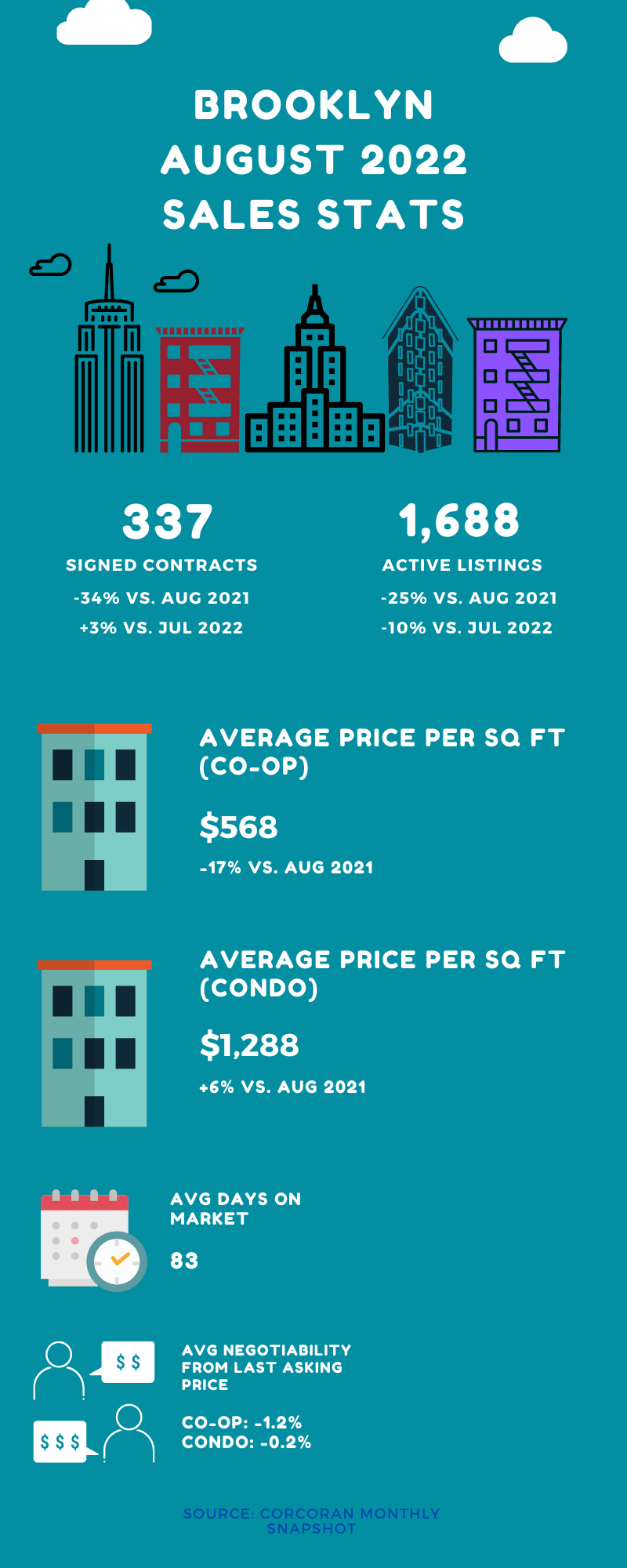

Contracts were also down significantly in Brooklyn yet up slightly month over month, mirroring its East River counterpart. And like Manhattan, sales were also still higher compared to August 2019.

Prices held mostly steady, with just a 1% increase both year over year and month over month.

Days on market were down 16% compared to the prior year, but up to the tune of 19% month over month. But inventory saw a significant year over year decline – down 25% compared to August 2021.

Sellers haven’t completely lost their edge, but they’re no longer in the driver’s seat. And this is evidenced by the negotiability factor standing at 0.5% below asking.

The sales market shift is continuing in both boroughs but as noted previously, prices might be saved from sharp declines due to lower inventory. This could change in the month of September, when the market generally starts to wake up from its “summer lull.” However, a lot of signs point to listing growth being a bit muted in the midst of seller concerns.

Inflation is still a top level concern and the Fed is mulling over another three quarter hike. While this is likely to keep some buyers on the sidelines, it may spur others to try to get deals done while rates are lower. And keep in mind, continuously rising rents may be tipping to scales in favor of buying for some, despite rising interest rates.

If you’re on the hunt for a new place to call home, then make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.