It’s time to take a look at the NYC real estate market update for Q3 2022. To view the report for the previous quarter, click here.

To view the full reports, visit the links below:

Corcoran NYC Real Estate Market Update Q3 2022 – Manhattan

Corcoran NYC Real Estate Market Update Q3 2022 – Brooklyn

The Breakdown

The slowdown that was previously predicted came to pass during the third quarter. And it was most evident in contracts signed which were down 29% year over year and 36% quarter over quarter. But it’s important to keep the decline in perspective. We’re comparing it against the record breaking year that was 2021!

The median price held fairly steady compared to the previous year at $1,180,000 – just 1% lower.

And thanks to shrinking inventory (down 11% versus the prior quarter), days on market tumbled by 30% compared to Q3 2021. The lower level of inventory also likely contributed to the strength of the average price per square foot which came in at $1,877 – an 8% annual increase.

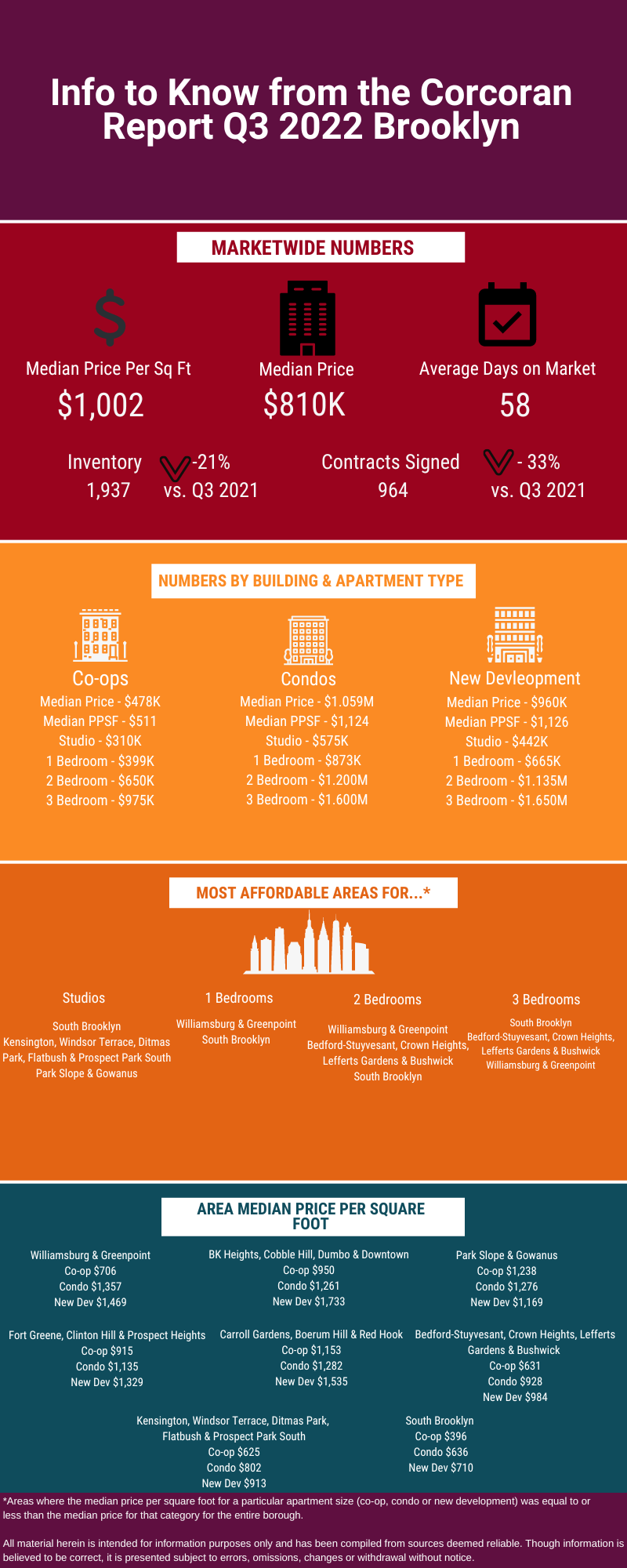

Brooklyn displayed similar trends during the third quarter. Contracts signed were down 33% year over year and 35% compared to the previous quarter. That being said, the pace of signed contracts is in line with the 5 year pre-pandemic average.

The median price ticked downward to $810,000. This was likely the result of buyers shifting their focus to lower priced listings to account for increased interest rates. And this also pushed the average price per square foot downward to $965 – a 2% decrease compared to Q3 2021.

But like Manhattan, days on market continued to decrease substantially year over year (to the tune of 31%) due to low inventory. In fact, Brooklyn saw its lowest level of inventory since Q3 2013.

The Takeaway

The market is likely at an inflection point at the moment, but not quite in the way that many might expect.

Higher interest rates are restricting the purchasing power of buyers and keeping many of them sidelined. But prices aren’t quite declining just yet.

The reason? Constrained inventory.

Sellers aren’t too eager to put their homes on the market at the moment. In addition to concerns about economic headwinds, few of them want to trade their current low interest rate homes for a home at a much higher interest rate.

So while buyers might have some negotiating power given the uncertainty felt by sellers who have listed their homes, they’re not seeing a lot of options. And this means the scales haven’t fully tipped in their favor (especially in Brooklyn).

We are going to finally see prices start to come down more meaningfully in the coming quarter. However, if inventory remains tight, it may not be a very sharp decline.

Overall, there are increasing opportunities out there for buyers – especially studio and 1 bedroom buyers. With rents continuing to rise, owning could make much more financial sense versus renting for someone looking to stay in place for a few years. Check out my latest blog post to see what I mean.

Thinking about buying but not sure if you’re ready? Then sign up for my First Time Buyer Bootcamp to help you figure it out! Join here!

And if you’re ready to buy or sell, you can set up a call to discuss with me right here – Schedule a Call

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.