It’s time to take a look at the NYC real estate market update for Q2 2023.

To view the full reports, visit the links below:

Corcoran NYC Real Estate Market Update Q2 2023 – Manhattan

Corcoran NYC Real Estate Market Update Q2 2023 – Brooklyn

Signs of market normalization are finally starting to emerge after several quarters of clear decline.

Although sales were down in Manhattan compared to Q2 2022, they were up by 48% compared to Q1 2023. Contracts signed also posted a quarter over quarter gain of 11%.

Inventory continued to grow on a quarterly basis, but it was slightly lower than Q2 2022 (down 2%). And days on market also saw a downward trend on a quarterly basis (down by 3%).

Prices aren’t quite where sellers would like for them to be, however. The median price, at $1,211,000 was a solid 10% higher compared to Q1 2023. But it was down slightly year over year. And the average price per square foot was down both quarterly and annually. So buyers still have a clear advantage in the borough.

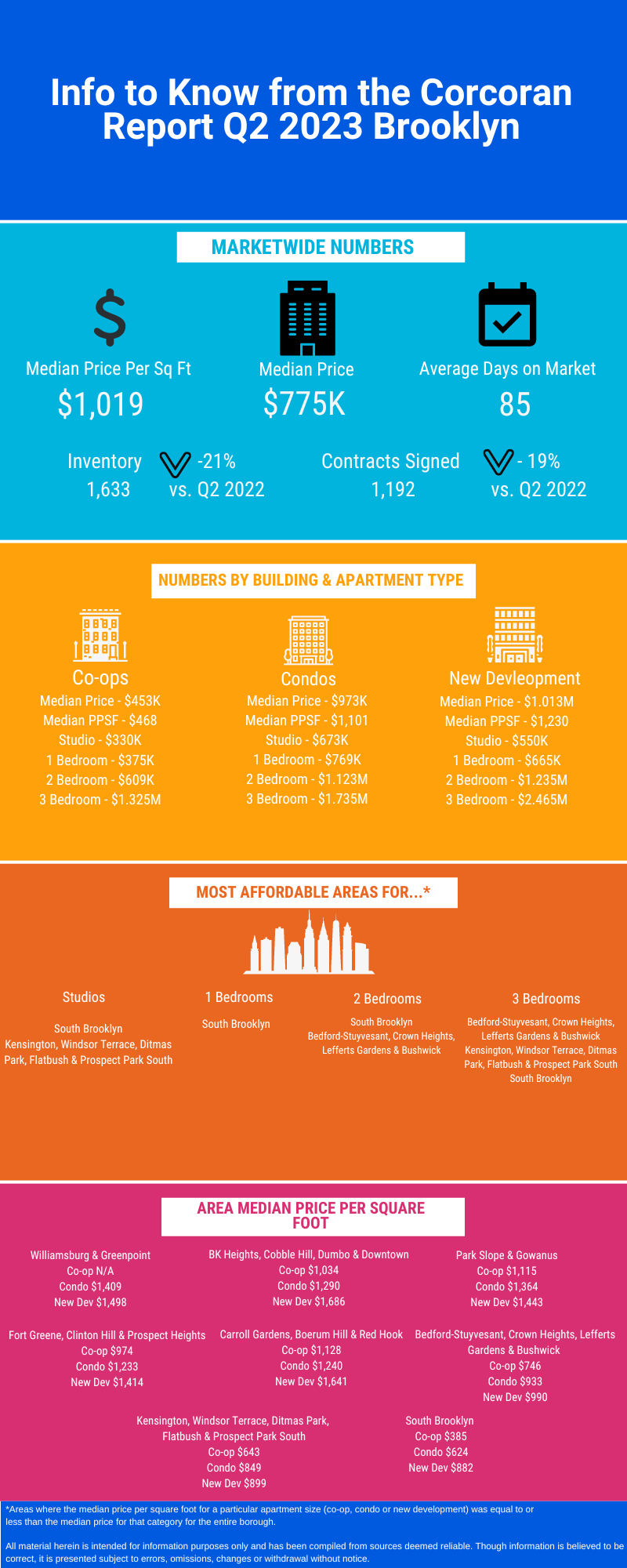

Brooklyn saw similar trends when it came to closed sales and signed contracts. Closed sales were down year over year (39%) but had a strong rebound in Q2 2023 (up 22%). Contracts signed also saw a big increase compared to Q1 2023 (up 36%).

The overall median price for the borough saw an annual decline of 6%, down to $775,000. But like Manhattan, this was higher than the previous quarter (by 8%).

Where the boroughs diverged was days on market, average price per square foot, and, most notably, inventory.

Unlike Manhattan, days on market were pretty even with 2022. And the average price per square foot was slightly higher than 2022.

The likely reason for that increase? Very tight inventory. Listings were down throughout the borough by 21% – a really significant decline. So buyers found themselves with stiff competition for desirable properties.

We’re now around the 1 year mark from when interest rates started increasing significantly. But we’re still likely to see year over year declines in closed sales during the third quarter. Why? Because sales are a lagging indicator. Closed sales in Q3 2022 were still being bolstered by the robust spring market of 2022. And it takes most deals in NYC at least 60 to 90 days to close.

That being said, more stable rates do seem to be encouraging market normalization as hoped. And with recent unexpectedly good news about inflation, the Fed is likely to be close to the end of the road when it comes to interest rates increases.

Despite higher interest rates, the buy signals remain strong in Manhattan due to inventory. Although there’s not necessarily an excess of listings, buyers do have more options and more negotiability. And buying looks especially attractive for studio and 1 bedroom buyers when compared to the stubbornly high cost of renting.

Brooklyn continues to be a trickier market for buyers, however. The inventory situation doesn’t seem to be improving. And given that summer tends to be a “quieter” season for new listings, that’s not likely to change over the next few months. So buyers will have to be prepared for fewer options and continued competition for prime listings. Even so, some buyers may still find buying a better option than renting, especially if they can find a place with low monthly carrying costs.

Thinking about buying but not sure if you’re ready? Then sign up for my First Time Buyer Bootcamp to help you figure it out! Join here!

Thinking about listing your home for sale but not sure where to start? Then check out my NYC First Time Seller Guide. You can get it here.

And if you’re ready to buy or sell, you can set up a call to discuss with me right here – Schedule a Call

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.