It’s time for the NYC monthly sales market update! Here’s a look at some key numbers for July 2023 in Manhattan and Brooklyn.

To view the full NYC sales market monthly update for July 2023, click here. And to view stats for the previous month, click here.

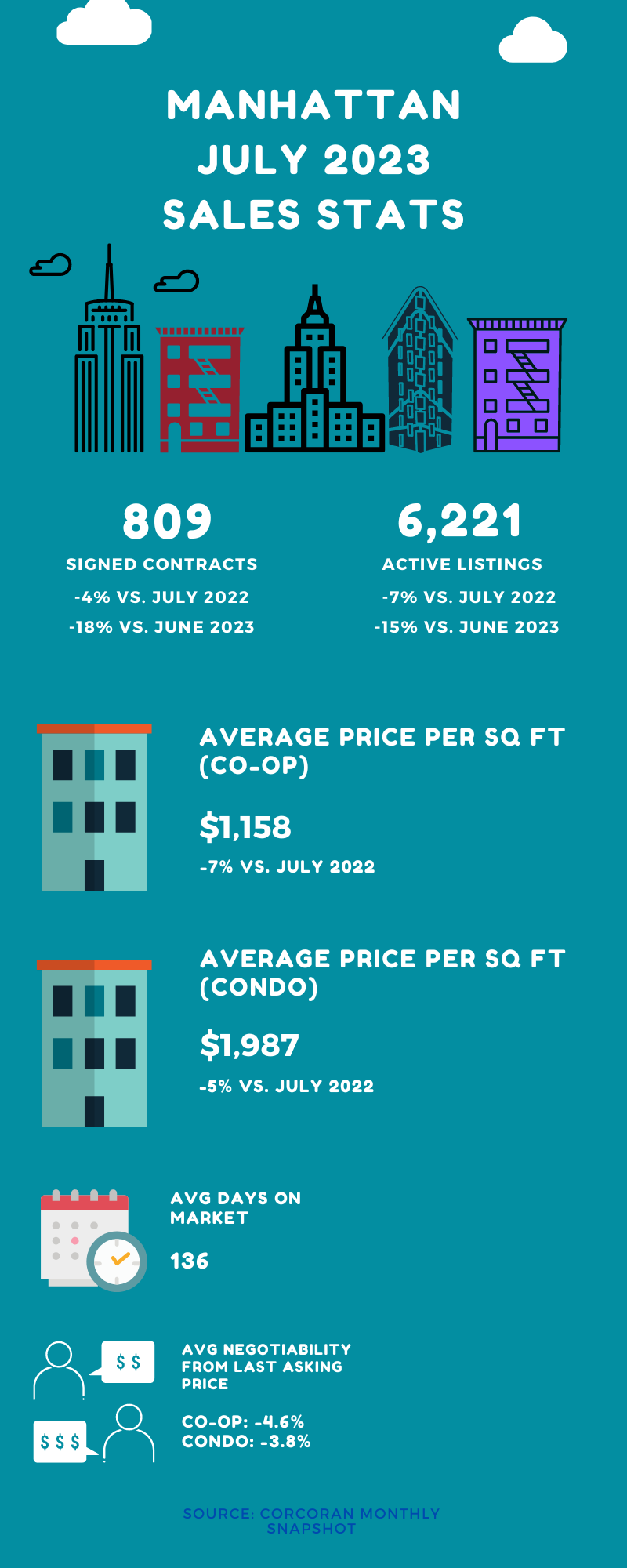

Contracts were down by 18% compared to June 2023, reflecting typical seasonal trends. And sales were also down on an annual basis by 4%. However, this is one of the smallest declines we’ve seen since April 2022, indicating further market stabilization.

Although days on market ticked upwards (to the tune of 16% compared to last year this time), inventory ticked downwards. This reflects both absorption (i.e. listings actually going into contract) plus sellers keeping properties off the market. That’s also not unexpected. Combined with summer’s reputation as a slow season, many sellers were also likely deterred by high interest rates.

Buyers still continued to hold the advantage in the market, with the negotiability factor sitting at 4.2% below asking for the month of July.

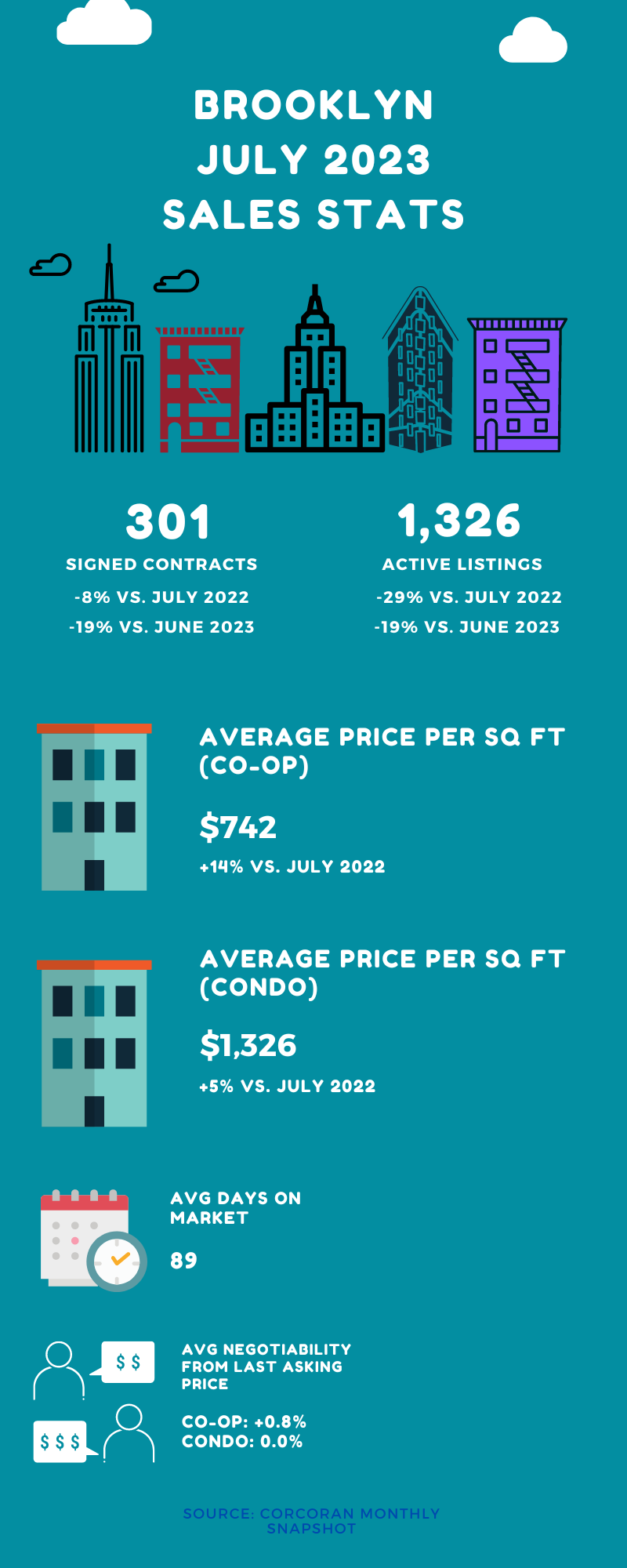

Sales showed similar trends in Brooklyn. Signed contracts were down by 8% year over year, but it was one of the smallest declines in over a year. And the month over month decline (19%) was pretty typical of seasonality.

Days on market were up markedly compared to last year this time (up by 27%), but they showed a decline compared to June. This was likely due to the same factor we saw last month – lingering listings finally finding buyers due to limited inventory. Prices saw an increase annually and monthly, but it was likely due to higher end sales in higher priced neighborhoods.

Sellers still held a slight advantage in the borough, thanks to the lower inventory. The negotiability factor stood at 0.4% above asking. But that’s smaller than what we saw in June, so sellers aren’t quite as “in charge” of the market in all segments.

August is likely to reflect more of the same in terms of sales patterns, as late summer tends to be a slower time of year for sales. So we can expect to see some yearly and monthly declines, albeit at lower levels.

Although there’s been some very good news recently about the economy, that’s actually making the Fed nervous about inflation. So there’s the distinct possibility of at least a small interest rate increase in the near future. Absent an influx of new and appealing inventory, this means buyers may continue to sit on the sidelines as they wait for rates to tick downard.

But despite the high interest rates, ownership may make more sense for some buyers thanks to high rents. And this continues to be the case for studios, 1 bedrooms and small 2 bedrooms. And if you’re looking in uptown Manhattan or south Brooklyn, even perhaps a 3 bedroom.

If you’re on the hunt for a new place to call home, then make sure you’re prepared! Get pre-approved! Understand your finances! And get my FREE First Time Buyer’s Guide!

Get my NYC First Time Home Buyer Guide FREE when you sign up for my monthly newsletter

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.